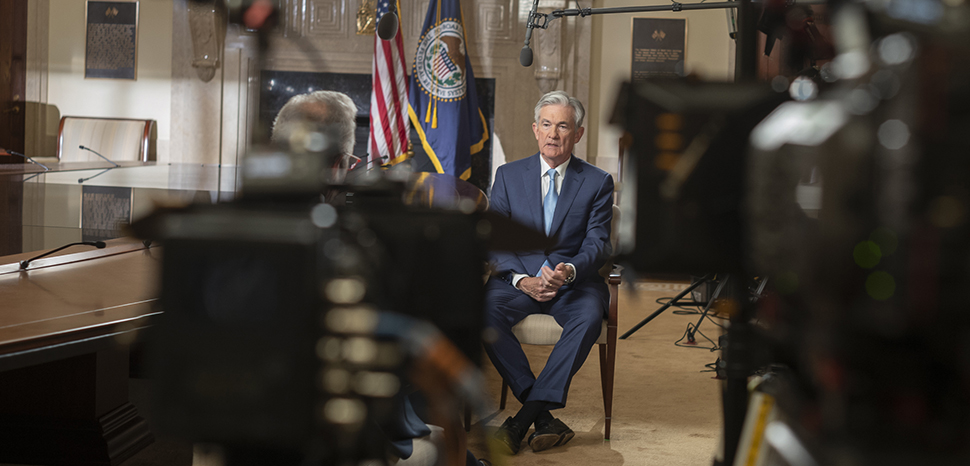

The US Federal Reserve enacted a 75-basis-point hike on June 15, the largest one-time hike since 1994. Fed chair Jerome Powell hinted that another 75-basis-point hike could be on the immediate horizon next month, pushing the benchmark rate over the 3% mark by the end of the year (there are four policy meetings remaining in 2022). Wednesday’s hike brought the benchmark range to 1.5-1.75%.

Five of the 18 members of the Federal Open Market Committee believe that the year-end benchmark rate will be significantly higher than that, settling somewhere over the 3.4% mark. Eight believe it will end up around 3.4%, and another five at around 3.2%. None of them predict a benchmark rate in excess of 4%.