Summary

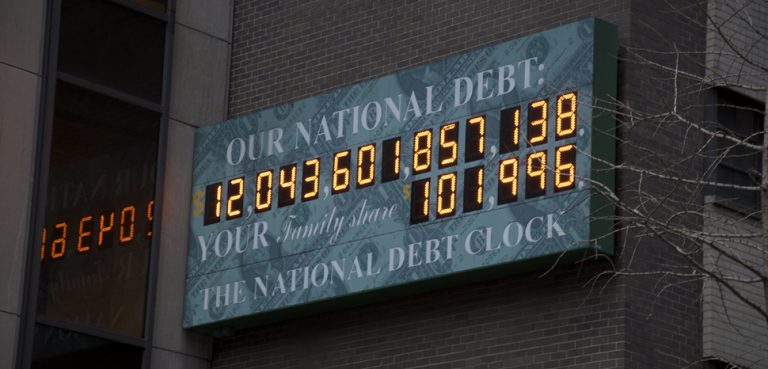

US federal debt levels are spiking, with debt-to-GDP projected to exceed 100% sometime next year. The current deficit, ballooned by federal stimulus from the COVID-19 pandemic, is expected to come in at 17.9% for FY 2020.

It’s hard to imagine this trend reversing itself anytime soon. Should an effective vaccine become widely available in the months ahead, the United States government will still have to contend with the economic headwinds of high consumer debt and unemployment, crumbling infrastructure, indebted state governments, and a dysfunctional global trade system – all of which will produce calls for more – not less – government spending.