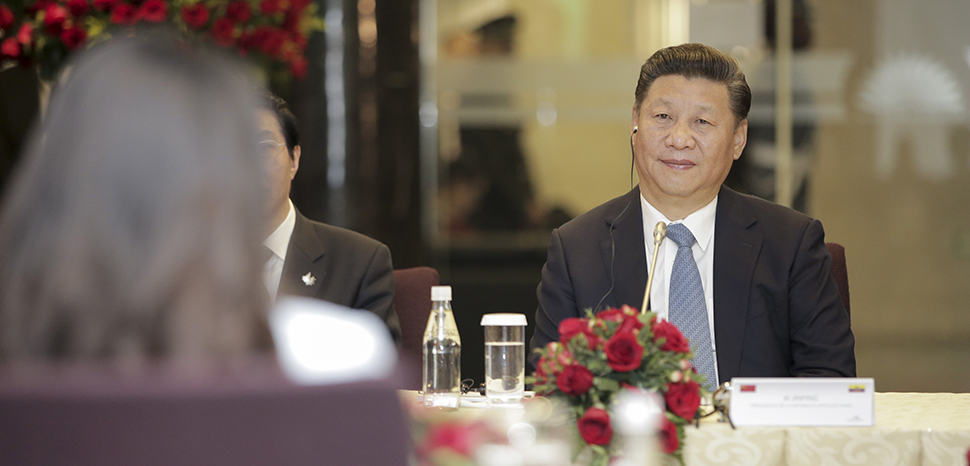

Xi Jinping has been steadily regressing toward the days of full communist control, undoing decades of liberalization that propelled China to record economic growth. He has centralized decision-making authority, bolstering his own power to silence dissenters, eliminate political enemies, and restrict civil society. Additionally, he has paused private-sector reforms. These actions have collectively slowed China’s economic growth. Coupled with China’s aggressive foreign policies, they have deterred foreign investment, leading to trade and investment being diverted to other countries.

Considering China’s growth trajectory leading up to the pandemic, it was anticipated that the country’s GDP would surpass that of the United States by 2035. However, due to slower growth, escalating mismanagement under Xi, and a mounting demographic crisis, it may take several decades before the Chinese economy outpaces the United States, and there’s a possibility it may never do so.

Over the past year or more, manufacturing activity in China has experienced a downward trend, coupled with a decrease in factory gate prices. Although the Purchasing Managers Index (PMI), a gauge of industrial activity, has shown some recovery since the start of 2024, factories are still cutting jobs.

Consumer spending shows little sign of improvement. Additionally, over the past three years, the Chinese stock market has witnessed a loss of $6 trillion in value. Local governments are grappling with mounting debt and potential insolvency, prompting some to halt construction and infrastructure investment. The real-estate market is edging toward crisis levels, with 50 of the leading developers facing potential insolvency. Unfinished construction projects number in the millions of units, leaving homebuyers to contend with the loss of their life savings.

China posted a respectable GDP growth rate of 5.2% last year; however, when adjusted for falling prices, the real growth rate is likely lower. This adjustment factors in the impact of deflation, which could diminish the actual increase in economic output. Furthermore, even a revised growth rate, which has been adjusted downward, is partially attributed to a short-lived surge in consumption following the lifting of COVID restrictions.

Despite a population decline of two million people, youth unemployment remains high. Similar demographic declines are being experienced by other countries, including most of Europe, Japan, and other parts of the developed world. However, the distinction lies in the fact that those countries were already wealthy, with mature economies, before birth rates began to fall. In contrast, although China ranks as the second-largest economy in terms of GDP, it ranks 72nd in terms of nominal GDP per capita. The average Chinese citizen only earns approximately $12,500 per year, which falls below the poverty line in many developed countries. Surprisingly, 75% of the middle class only earn between $10 and $20 per day.

For nearly a decade, Xi Jinping has expressed a desire to shift China from a manufacturing and export-driven economy to one fueled by domestic consumption. However, this vision has yet to materialize due to citizens’ reluctance to spend in China’s struggling economy. Recently, he has been advocating for the New Productive Forces model, aiming to drive economic growth through innovation and new technologies. Technologies like AI could potentially modernize China’s industrial sector, boosting worker productivity and enhancing the competitiveness of Chinese exports. Premier Li Qiang has hailed this shift to New Productive Forces as a “new leap forward,” but it is actually a step backward, as it would mean reverting China to a factory-driven, export-dependent economic model.

Like the other slogans under Xi’s leadership, such as the ‘Chinese Dream,’ ‘Common Prosperity,’ and ‘Dual Circulation,’ the concept of New Productive Forces lacks substantive detail, and the methods by which the CCP intends to achieve this goal remain unclear. However, it is evident that, alongside a return to export-led growth, New Productive Forces will involve government subsidies. This expansion of the government’s role in the economy diverts resources from citizens and public services, potentially hindering consumption. Moreover, prioritizing New Productive Forces could divert attention from addressing systemic issues, such as the real-estate crisis and potential banking crises resulting from defaults in the real-estate sector.

China has traditionally relied on increasing government control during times of crisis, but there are several more constructive measures Xi could consider. He could establish a stabilization fund to bolster struggling equity markets and have unfinished properties taken over by the government to ensure completion, thereby safeguarding buyers from financial losses. Restructuring local government debt and implementing a stimulus program to boost consumer spending are also viable options. Additionally, increasing the social safety net for the elderly could alleviate the burden on working individuals and encourage middle-class spending rather than retirement saving. Revisiting the official retirement age, currently set at 60 for men and 55 for women, is another possibility. However, Xi has yet to pursue any of these avenues.

Going by Xi Jinping’s track record, however, it appears unlikely that he will enact a significant stimulus package or embark on structural economic reforms.