Summary

In June of last year, the Bank for International Settlements released its annual economic report in which it flagged the growth of corporate debt as a growing systemic risk.

In the report’s own words:

The corporate sector in some countries [in the developed world] has shown clear signs of overheating… Perhaps the most visible symptom… is the remarkable growth of the leveraged loan market, which has reached some $3 trillion. While firms in the United States – and, to a lesser extent, the United Kingdom – have accounted for the bulk of the issuance, holdings are spread out more widely. For quite some time, credit standards have been deteriorating, supported by buoyant demand as investors searched for yield. Structured products such as collateralized loan obligations (CLOs) have surged – reminiscent of the steep rise in collateralized debt obligations that amplified the subprime crisis.

This corporate debt burden grew on the back of a decade of loose monetary policy and record-low interest rates. For years, companies have been taking out new loans to pay off old ones. Such leveraging has occurred against a growing chorus of warnings that, sooner or later, an economic shock would come along to trigger a cascade of defaults. It wouldn’t take much; the IMF warned last year that almost 40% of the corporate debt in eight leading developed countries (including China) would be rendered unserviceable in the event of a downturn only half as serious as the 2008-2009 financial crisis.

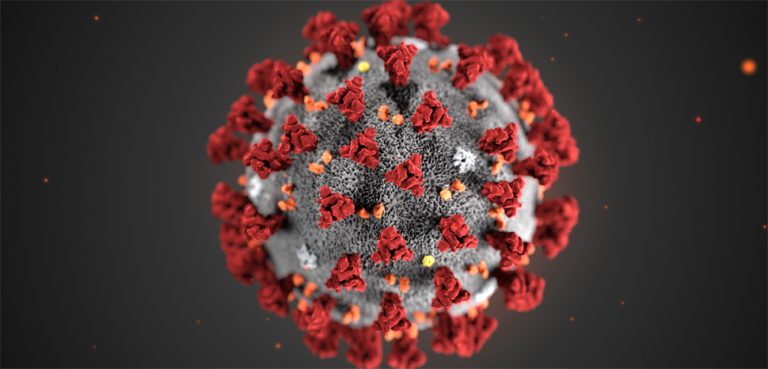

A COVID-19 induced recession could just bring about this reckoning long foretold.