Summary

The decade ahead will bring massive structural shifts as economies around the world transition away from fossil fuels. These changes have already given rise to new strategic commodities, such as rare earth minerals, cobalt, and lithium to name a few. The extent to which major economies are willing to clash over these strategic commodities in order to secure reliable supply chains remains to be seen, and will largely be a function of the global trade system going forward. However, the fact remains that supply chain security will be a matter that no policymaker has the luxury of ignoring.

This article will examine the factors underpinning demand for lithium.

Background

What is lithium?

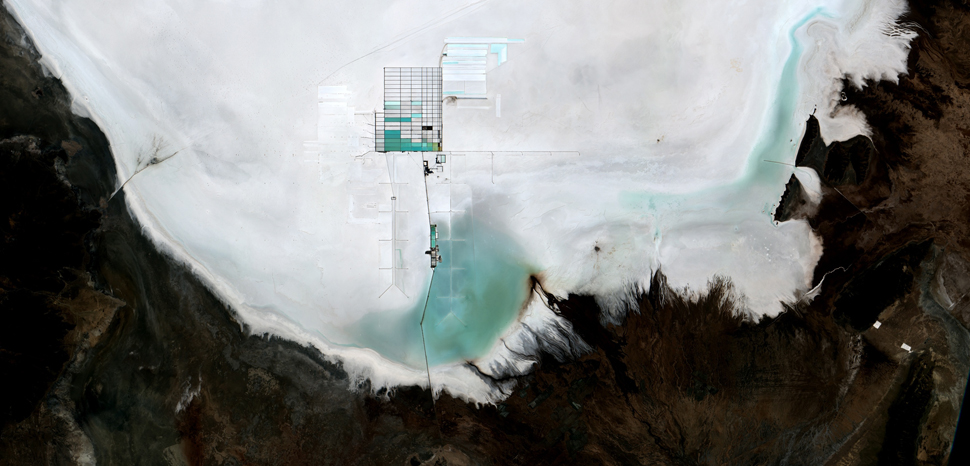

Lithium is a silvery-white alkali metal that is lighter, more stable, more environmentally friendly to extract, and more energy dense than alternative battery chemistry elements such as nickel-metal and lead-acid. These properties have helped make lithium-ion batteries an essential input in electric vehicles and intermittent renewable energy storage (solar, wind, e.g.) – industries that are expected to boom as the global economy transitions away from fossil fuels over the next decades. However, global lithium demand is not completely dominated by battery technology – at least not yet. Just under half of current demand stems from industrial applications (glass and ceramics, lubrication, polymers, etc.).