Summary

The years ahead will bring massive structural shifts as economies around the world transition away from fossil fuels. These changes have already given rise to new strategic commodities, such as rare earth minerals, cobalt, nickel, and lithium to name just a few. The extent to which great powers are willing to clash over these strategic commodities in order to secure reliable domestic supply chains remains to be seen, and will largely be a function of the global trade system going forward. However, supply chain security is an issue that policymakers no longer have the luxury of ignoring.

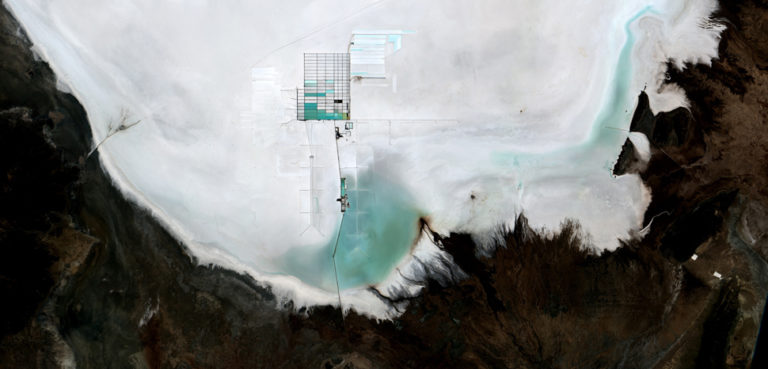

This article examines factors impacting lithium supply over the next decade.