Core Insights:

- The impact of Red Sea tensions on global inflation appears understated.

- Container shipping rates are climbing toward their pandemic-level highs.

- Geopolitical risk posed by Houthis and other ‘bad actors’ in the MENA region likely to increase over medium-term.

Summary

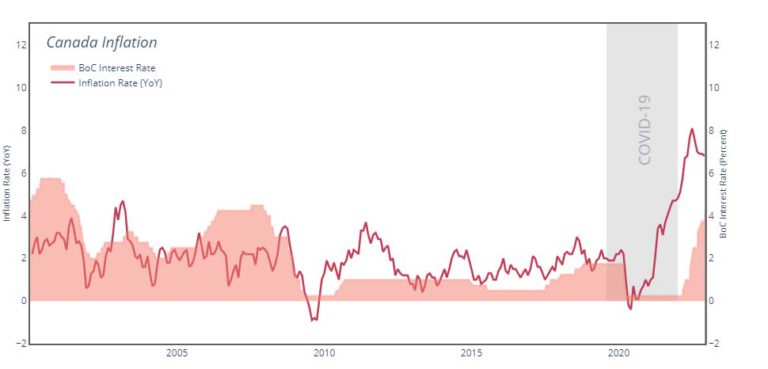

Post-pandemic inflation left economic scarring throughout the Western world in the form of cost-of-living crises and mounting debt concerns. Now policymakers are eager to turn the page and return to the low-rate environment of recent history, with two examples being the Bank of Canada and the European Central Bank, both of which have recently signaled a new easing cycle by cutting rates by 25 basis points. But has the global economy actually succeeded in putting the inflation genie back in the bottle, or will geopolitical instability thwart a return to business-as-usual? This article will seek out an answer by exploring one source of near-term inflation – global shipping costs – which are spiking in the wake of the Red Sea shipping crisis.

Impact

Red Sea Shipping Crisis

The Red Sea shipping crisis continues to ripple throughout global supply chains. The Suez Canal, a shipping choke point that typically accounts for around 30% of global container traffic, has seen traffic drop by a remarkable 80% since the Gaza War broke out in November of 2023. Asian shippers are instead opting for the safety of rounding the Cape of Good Hope en route to Europe, extending freight times by up to 30%. Longer journeys are being reflected in higher container freight costs, which are now climbing toward pandemic-era highs. These costs will ultimately be borne by consumers, though there’s disagreement over to what extent, with estimates ranging from 0.3% to 2% in increased goods inflation. The takeaway here is that elevated shipping costs will generate upward price pressure so long as Red Sea routes remain threatened. According to Nora Szentivanyi of JP Morgan: “… even a modest rebound in goods inflation could render global core CPI inflation sticky around the 3% mark.” This is a significant number given the stated inflation target of 2% across much of the Western world, even more so given the increased political weight attributed to cost-of-living concerns by voters in major economies like France, the United States, and Canada.