Ever since its largely unremarkable inception in a speech at Kazakhstan’s Nazarbayev University in 2013, President Xi’s landmark Belt and Road Initiative (BRI) has represented a moving target for analysts and policymakers. The branding has evolved – from a Maritime Silk Road of the 21st century, to One Belt One Road, before finally settling on the current form. So too has the project’s geographic scope, which branched out from its original Eurasian focus to eventually encompass Africa, Oceania, Latin America, and even the Arctic. And in a shift beyond the original economic thrust of promoting infrastructure development, Belt and Road has evolved into a banner under which numerous educational, environmental, and technological exchanges proliferate around the world. Just two of many examples include the ‘Digital Silk Road,’ which seeks to expand the footprint of China’s tech giants and afford them a larger role in shaping global standards, and the ‘Space Silk Road’ which facilitates satellite launches and technical cooperation among developing countries.

It’s not only the Belt and Road Initiative that has been changing over the past decade. Shifts in the global distribution of economic and diplomatic power have also unfolded, leading to a gradual eclipse of US preeminence that has favored the expansion of the BRI, a platform that is generally presented as an alternative to traditional Western circuits of development finance. A similarly upward trajectory can be discerned in two other young institutions synonymous with China’s expanding global clout – the BRICS grouping and the Asian Infrastructure Investment Bank (AIIB) – both of which have expanded their membership and diplomatic influence in recent years.

From the vantage point of 2023, the historical weight of Belt and Road is undeniable. Even those ascribing a more nefarious or ideological dimension to China’s motivations are inclined to admit that BRI has become emblematic of not just the Xi Jinping era of Chinese politics, but also a wider paradigm shift in how Beijing views its place in international society. But does the high visibility and global reach of Belt and Road mean that the project has achieved its original objectives? This question will be explored in greater depth in the sections below.

“Mobilize resources, leverage growth drivers, and connect markets”

Mobilizing Resources: China as a Developmental Finance Superpower

Belt and Road can be viewed as ‘globalization with Chinese characteristics’ and, like conventional globalization, it is a fundamentally economic phenomenon that over time inevitably creeps into the political and military spheres, ultimately generating ever-deeper integration and dependencies. The central pillar of BRI remains trade facilitation via the creation of hard infrastructure (ports, roads, rails) and reduction of cross-border trade barriers (customs, inspections, quarantine). And the overriding goal is to connect global markets to the economic hub of China, thus securing an unimpeded stream of primary inputs and a permanent consumer base for Chinese exports.

The endeavor has above all entailed massive outlays of infrastructure finance to the developing world. It’s generally believed that over $1 trillion has been spent so far, with estimates varying due in part to frequent confusion over whether a given project bears the official BRI branding. These expenditures have propelled China to the commanding heights of global development finance: the country now spends around $85 billion per year on foreign infrastructure development, outspending the United States and other major powers on a 2-to-1 basis or more.

China’s spending also differs qualitatively from other global lenders.  For one, it overwhelmingly favors loans over grants. In the BRI era, China has adopted a 31:1 ratio of loans to grants, and a 9:1 ratio of Other Official Flows (OOF) to Official Development Assistance (ODA). State-owned lenders have also extended loans with higher interest rates and shorter grace periods and maturation horizons than multilateral creditors on average. In an examination of 100 leaked BRI contracts – just a small sample of the tens of thousands of agreements that remain shielded from public scrutiny – Anna Gelpern et. al identify several distinctive characteristics of this surge in Chinese lending: 1) development loans are largely opaque and subject to extraordinarily strict confidentiality clauses; 2) loans tend to restrict the possibility of multilateral collective bargaining mechanisms such as the Paris Club process; and 3) loans often include various cancellation, linkage (to other China-linked loans), and repayment restrictions that together amount to extraordinary leverage on the part of the creditor, amplifying Beijing’s economic and political influence over borrowing parties.

For one, it overwhelmingly favors loans over grants. In the BRI era, China has adopted a 31:1 ratio of loans to grants, and a 9:1 ratio of Other Official Flows (OOF) to Official Development Assistance (ODA). State-owned lenders have also extended loans with higher interest rates and shorter grace periods and maturation horizons than multilateral creditors on average. In an examination of 100 leaked BRI contracts – just a small sample of the tens of thousands of agreements that remain shielded from public scrutiny – Anna Gelpern et. al identify several distinctive characteristics of this surge in Chinese lending: 1) development loans are largely opaque and subject to extraordinarily strict confidentiality clauses; 2) loans tend to restrict the possibility of multilateral collective bargaining mechanisms such as the Paris Club process; and 3) loans often include various cancellation, linkage (to other China-linked loans), and repayment restrictions that together amount to extraordinary leverage on the part of the creditor, amplifying Beijing’s economic and political influence over borrowing parties.

The limited public data on how these loans are collateralized points in different directions. Research from AidData found that 40 of the 50 largest loans from China state-linked creditors offered collateral in the event of default, and that 83% of loans to countries that fell in the bottom quartile of global fiduciary risk were collateralized. This would seem to suggest that collateralization is Beijing’s preferred risk-mitigation strategy. However, leaked contracts elsewhere hint at less severe risk mitigation measures. Upon examination of a leaked BRI contract for road construction in Kyrgyzstan, Michael Schroeder found no such collateralization clauses, though noted the possibility of political influence being exercised through the various atypical clauses outlined above. All in all, while collateralization appears to be a recurrent theme in high-risk projects, its overall prevalence cannot be determined so long as the vast majority of BRI agreements remain secret.

In closing it’s worth noting that BRI-related infrastructure finance has helped fill a market gap in the chronic shortage of infrastructure finance across the developing world, with annual investment requirements estimated at anywhere between $2.9-$6.3 trillion. Even taking the high outlays of BRI-related finance into account, infrastructure investment is still expected to fall short by around $360 billion annually through 2040. In many cases, Chinese finance is the only option available for governments seeking to build critical infrastructure, and this lack of competition helps explain the favorable terms that Chinese lenders have often managed to secure in BRI contracts.

Leveraging Growth Drivers: BRI as an Economic Engine

Another clause in the abovementioned Kyrgyzstan contract is noteworthy: “the goods, technologies and services purchased by using the proceeds of Facility shall be purchased from China preferentially, and the technical standards to be used shall follow relevant Chinese and international standards.” Here the borrowing party is legally obliged to purchase labor and inputs sourced from China, and to abide by Chinese standards to the ultimate detriment of any potential competitors in the global arena. Thus, it’s not only favorable financial terms where China’s core interests are advanced. It’s also the domestic economic tailwinds produced from Chinese labor, inputs, and expertise being exclusively used to build some of the largest infrastructure projects in the world.

In this sense, Belt and Road is an externalization of the supply-side economics that drove China’s breakneck economic development since the 1980s. State-directed infrastructure investment has played an outsize role in China’s modern development story, so much so that infrastructure stimulus remains a policy failsafe to be reverted to in times of economic trouble. Yet Beijing’s domestic infrastructure spending has proven so prolific that it is now producing diminishing returns. Anecdotes of ‘roads to nowhere’ and ‘ghost cities’ proliferate as all levels of government try to generate economic activity through state-led construction, leaving ballooning debt loads in their wake. Enter the Belt and Road Initiative, which represents a proverbial escape hatch from infrastructure oversaturation without having to forego the perks of China’s established economic model. Moreover, BRI allows the debt risks inherent to domestic infrastructure development to be circumvented by offloading them onto borrowing countries; though, as later sections will illustrate, these risks cannot be mitigated entirely.

The economic benefits of BRI are reflected in the annual statements of China’s largest state-owned construction companies. China Railway Group (CREC), a major player that helped build notable BRI links such as the China-Laos and Addis Adaba-Djibouti railways, saw its revenue nearly double from 558 billion yuan in 2013 to 1,073 billion in 2021. China Railway Construction Corp (CRCC), a rail giant with over 340,000 employees, saw its Fortune 500 ranking of global companies jump from 100 to 39 over the same span. Taken together, from 2014-21, Chinese iron and steel makers invested some $17.5 billion in BRI countries, up from $4.7 billion over the previous eight years. These surging investment flows, facilitated in large part by the state under the BRI banner, have helped Chinese SOEs become five of the largest construction firms in the world.

Connecting Markets: China as Global Trade Hub

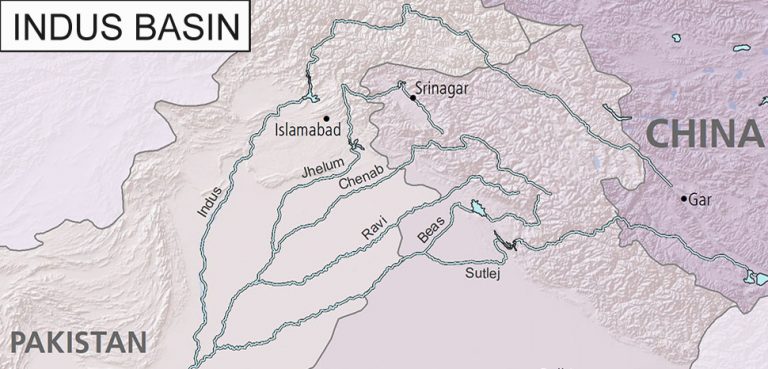

There is a more farsighted aspect to BRI that goes beyond debt leverage and domestic overproduction: the project endeavors to situate China at the center of a new global economy that will characterize trade flows for decades if not centuries. As such, the BRI infrastructure projects that tend to receive the most ardent support from state-linked entities are those that form new spokes connecting back to the hub of the Chinese economy. One example is Pakistan’s Gwadar Port, which represents a maritime link to Xinjiang that can circumvent the choke point of the Strait of Malacca; another is the vast network of roads and railways that with every passing year draws the economies of Southeast Asia ever closer to China. This objective of creating new hard infrastructure links echoes the large body of literature illustrating how such connections can boost overall trade volumes and facilitate industrialization, particularly when a region suffers from a severe infrastructure deficit (which is widely true of BRI members). ‘Soft’ barriers, such as incompatible or inefficient legal and regulatory frameworks, can also act as impediments to cross-border trade flows, and high-level official speeches often ascribe as much weight to the importance of establishing ‘soft connectivity’ through the harmonization of cross-border frameworks as to the building of hard infrastructure itself.

Europe was always a natural target for greater connectivity given its importance as an export market, and early efforts to establish a direct rail corridor under BRI are now reaching fruition. The link is composed of two routes at various stages of completion.  The first of these is the Northern Corridor, which is essentially Russia’s Trans-Siberian Railway extended to link up with Beijing and Dalian. Second is the Central or Middle Corridor which runs from Lanzhou in central China and through the Kazakh ‘dry port’ of Khorgos, where cargoes must be offloaded to account for different rail gauges, before branching northward to the Russian route or southward to join up with the Trans-Caspian International Transport Route (TITR) joining Kazakhstan, Azerbaijan, Georgia, and Turkey via the Caspian Sea. This southward branch has seen its appeal boosted since the outbreak of the Ukraine war as European shippers seek to avoid traversing Russian territory for fear of sanctions. The portion could be expanded further to incorporate Iran in the future, improving transit times by bypassing the Caspian Sea crossing and potentially even linking up with the India-championed International North-South Transport Corridor (INSTC).

The first of these is the Northern Corridor, which is essentially Russia’s Trans-Siberian Railway extended to link up with Beijing and Dalian. Second is the Central or Middle Corridor which runs from Lanzhou in central China and through the Kazakh ‘dry port’ of Khorgos, where cargoes must be offloaded to account for different rail gauges, before branching northward to the Russian route or southward to join up with the Trans-Caspian International Transport Route (TITR) joining Kazakhstan, Azerbaijan, Georgia, and Turkey via the Caspian Sea. This southward branch has seen its appeal boosted since the outbreak of the Ukraine war as European shippers seek to avoid traversing Russian territory for fear of sanctions. The portion could be expanded further to incorporate Iran in the future, improving transit times by bypassing the Caspian Sea crossing and potentially even linking up with the India-championed International North-South Transport Corridor (INSTC).

The creation of the Eurasian Land Bridge cast China’s BRI in a primarily facilitating role: offering finance and diplomatic impetus for modernizing, harmonizing, and joining up pre-existing national rail networks. These efforts are now paying off, evident in the total 40,000 China-Europe freight trips on a route that prior to 2011 did not functionally exist. In 2021 alone, the China Railway Express (CR Express) – the callsign under which over 50 Chinese cities are connected to 24 European countries via 82 routes – operated over 15,183 trains carrying 1.46 million TEUs of cargo.

A similar process is unfolding in Southeast Asia, although the region’s pronounced infrastructure gap has forced BRI to play a more active role in financing and building new transport lines. Examples include Laos’ transborder railway connecting Vientiane with Kunming; the extension of said railway onward to Bangkok (expected to be completed in 2028); Cambodia’s toll expressway linking Phnom Penh and Sihanoukville (incidentally the site of a rumored future PLA Navy base); and Malaysia’s East Coast Rail Link (ECRL). In addition, plans exist to bridge the Thailand rail system with that of Cambodia and (even more ambitiously) Malaysia, along with a planned modernization of Vietnam’s Lao Cai-Hanoi rail link connecting the capital to China’s border. The overall vision for Southeast Asia mirrors that of the Eurasian Land Bridge: an interconnected regional transit system moving goods and people, with China forever at its core.

Conclusion

In light of the above, it would appear difficult to argue that BRI has not been a major success: the initiative has increased China’s diplomatic influence, stimulated growth internally and externally, and helped to ensure China’s ongoing centrality in regional trade networks for decades if not centuries. Yet a final determination cannot be made without embarking on a closer look of the risks that Beijing has taken on in pursuit of these goals. That will be the topic of the next article in this series.

*This article was originally published on September 21, 2023.