Since August 2020 West Africa has so far witnessed four attempts to undermine democracy. After two coups in Mali, and a failed attempt in Niger, the September military takeover in Guinea demonstrates that the region is yet to gain political stability. Having raised reasonable concerns about human rights violations, the previous events were still mostly ignored in other parts of the world. This time, however, the situation might be different, as the 2021 Guinea coup might potentially disrupt one of the world’s most important supply chains: aluminum.

Guinea and aluminum

Guinea appears to be a nation with some of the world’s largest deposits of bauxite ore – the main feedstock for aluminum production. With an estimated reserve of 7.4 billion tons, it stands out as the number one bauxite-producing country of the world. In fact, a fifth of the world’s aluminum is derived from Guinea’s raw materials. Hence, uninterrupted supplies of bauxite from this country are extremely important for the stability of global aluminum industry. That is why any potential interruptions in Guinea’s supplies or even rumors about them are likely to send shockwaves through the entire aluminum market.

This is actually what was feared by Oleg Deripaska, a Russian oligarch and founder of Rusal, the world’s second-largest aluminum producing company. Right after the first news on the coup, in his Telegram channel, Deripaska warned that the events in Guinea may ‘shake the aluminum market.’ And they did. Just hours after President Alpha Condé was ousted, aluminum prices rose to their highest level in a decade.

While this abrupt spike generally stems from concerns over global supply disruptions, aluminum prices were steadily rising even before the coup in Conakry. In fact, they have been in constant growth since late-2020, which could generally be attributed the gradual recovery of the global economy. Nevertheless, the coup has lifted them to new heights. Booming aluminum prices, in turn, have driven up the cost of everything that the metal is used for, from packaging foil to beer. More severely, however, this rise could significantly impact the car industry of the future.

Aluminum and Tesla

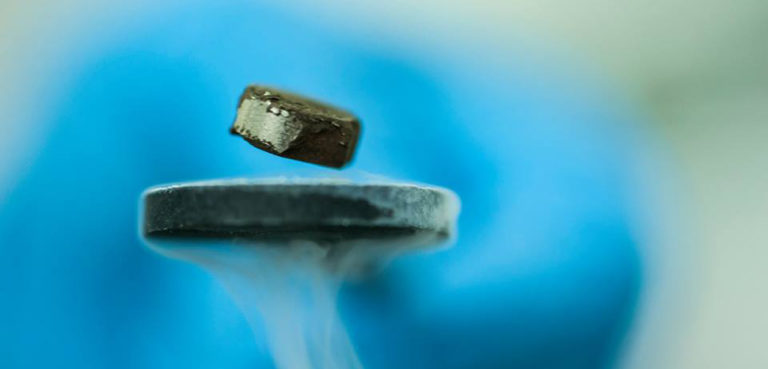

At the moment, aluminum is the fastest-growing automotive material. With the overall transition of the car industry to electric vehicles (EVs), it is expected to be in even greater demand in the years to come. This is because of unique features that make it more and more preferable to steel in the eyes of manufacturers. Specifically, its better corrosion resistance, better absorption of crash energy, and, more importantly, lighter weight; aluminum is often called ‘the EV manufacturers’ dream metal.’ Indeed, with the weight of batteries often constituting up to a quarter of the total weight of electric cars, car makers are using more aluminum to keep EVs lightweight and ensure they can run a long distance on one charge.

Since aluminum per se is significantly more expensive than steel, a lot of mass models of electric vehicles have opted to explore the market with car bodies made of cheaper steel. Yet even the cheapest and most steel-reliant EVs are still using substantial amounts of aluminum. For instance, the e-Golf has 129 kg of aluminum and the Leaf uses 171 kg of the metal. In this context, Tesla appears to be a more luxurious alternative that, in contrast to its rivals in the industry, favors aluminum a lot more.

For instance, while Tesla Model 3, the US and world’s absolute best-seller among plug-in cars in 2020, is made of a blend of steel and aluminum, with the latter constituting at least half of its body. Model S, by comparison, is almost entirely reliant on aluminum, which is used for the production of its body plates and chassis, accounting for up to 661 kg per vehicle. In Model Y, the most popular US electric vehicle in 2021, two enormous aluminum castings replace about 70 parts.

In 2020, Elon Musk announced that a cheaper Tesla would be ready ‘in about three years.’ Here, since the main effort of the company’s cost-reduction strategy is applied to designing a cheaper and more powerful battery, no transition to a cheaper key material for the car’s body has been expected. Hence, booming prices for aluminum are likely to have a profound impact on the ultimate costs of Tesla cars. Unfortunately, this impact will most probably only be for the worse – the fancy car might become even more expensive.

Thus, if your long-cherished dream is to get a Tesla, you might need to hurry up.

The views expressed in this article are those of the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com. The content of this article does not constitute financial advice from either the author or Geopoliticalmonitor.com.