There is widespread consensus that globalization is currently experiencing a significant transformation as reflected in the increasingly common narratives of ‘slowbalizaion’ and ‘deglobalization.’ The surge in protectionist measures, a ‘return’ of industrial policy, and the limitations of institutions such as the WTO paint a substantially different picture compared to the optimism of the 1990s and the early 2000s. Although we can attribute this transformation to several factors, the rise of geopolitically disruptive events in recent years undeniably ranks high among them.

In fact, several recent surveys highlight the growing importance of geopolitical risk for companies, investors, and the global economy. According to an Oxford Economics survey, companies view geopolitical tensions as the biggest threat to the global economy, with the majority acknowledging these tensions as a significant risk in the years ahead. Echoing the sentiment is a recent survey among Goldman Sachs clients, which cited geopolitical as a top concern for investors in 2024.

As these sentiments indicate, it is evident that geopolitical risk is increasingly impacting the global economy and influencing the course of globalization. As noted, the surge in geopolitical disruptions leads to the return of trade protectionism and industrial policy. However, it is crucial to recognize that not every geopolitical event or trend affects globalization and its stakeholders in the same manner. In fact, distinct dimensions of globalization can be identified, each disrupted in a unique way by geopolitical events.

The DHL Global Connectedness Index report conducts an annual review of the state of globalization, examining flows between countries categorized into four components: trade, capital, information and people. These components can be seen as different dimensions of globalization. Geopolitical shocks affect all of these dimensions, although some of them are not traditionally at the forefront of geopolitical scrutiny for companies, investors, and economic actors.

Red Sea Tensions and Global Information Flows

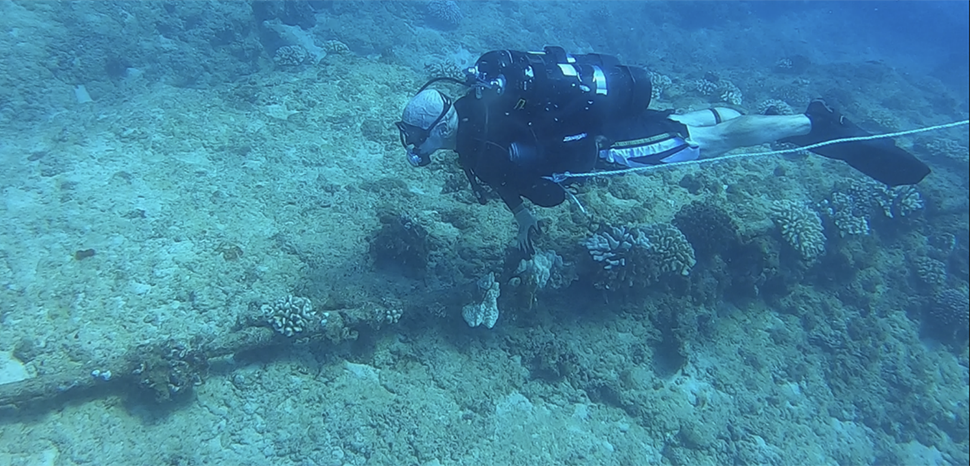

An illustrative example of that is the recent cutting of underwater cables in the Red Sea, an act that some parties attribute to Houthi rebels in Yemen. While the Houthis officially denied any responsibility, one of the affected telecoms cable operators told the Associated Press that the ‘affected segment lies within Yemeni maritime jurisdictions in the Southern Red Sea.’ Furthermore, the officially-recognized Yemeni government had warned about potential Houthi sabotage of submarine cables in the Red Sea, after a Houthi-linked Telegram channel published a map of the underwater network.

While disruptions in shipping, and consequently, trade, receive the majority of attention from analysts and the press regarding Houthi actions in the Red Sea, potential disruptions to information flows are often overlooked. This is because information flows are more commonly associated with cyber-attacks, generally falling within the domain of cybersecurity.

In general, disruptions to the global flow of capital and trade get most of the attention when considering geopolitical shocks, especially concerning their potential economic effects. One example is the increasing competition between the U.S. and China, which has resulted in many companies looking to relocate their assets to territories with reduced risk of geopolitical disruptions. Furthermore, trade flows are also widely known to be affected by geopolitical risk, as the very disruptions on the Red Sea due to Houthi attacks to commercial vessels have shown, among other several examples.

Nonetheless, the cutting of the undersea cables demonstrates that, in this era of growing geopolitical volatility, all dimensions of globalization can be impacted by these conflicts. While disruptions to trade and capital flows will undoubtedly remain pressing issues for economic stakeholders, underestimated aspects such as information flows merit closer examination. The undersea cables remain crucial in this regard.

The Importance of Undersea Cables

The immense importance that undersea cables represent in the wider global economy was highlighted by Admiral James Stavridis, a former US navy officer, who stated that “it is not satellites in the sky, but pipes on the ocean floor that form the backbone of the world’s economy.” Indeed, cables provide a significantly larger capacity for information transmission, and in a considerably more cost-effective way. In fact, 99% of international information traffic travels through these cables. Thus, ensuring their physical security remains a key component of global economic stability.

The Red Sea incident resulted in damage to four undersea cables, significantly affecting 25% of data traffic flowing from Asia to Europe. The unclear cause of the damage underscores an intrinsic problem with undersea infrastructure when it comes to risk assessment. Over 70% of cable faults result from accidental damage, such as fishing nets, anchors, or shark bites, creating an ideal ‘gray zone’ for potential attackers. Establishing culpability in such cases is extremely challenging, amplifying the vulnerability of undersea cables to intentional or unintentional threats.

States have become increasingly aware of the significant risks posed by threats to cables and the severe disruptions they can cause to information flows, as evidenced by the recent establishment of NATO’s Maritime Centre for the Security of Critical Underwater Infrastructure. Nevertheless, this critical issue tends to be widely overlooked in corporate geopolitical risk assessments and strategy, as they primarily focus on disruptions to other dimensions of globalization.

Evaluating the risks associated with disruptions in information flows is a pressing concern for multinationals, investors, and anyone engaged in global economic activities. The recent Red Sea tensions serve as a poignant illustration highlighting that geopolitical events compel stakeholders to cultivate a comprehensive understanding of today’s and tomorrow’s challenges.

Fernando Prats is the Director of the Latin America Programme at London Politica, specializing in Latin American politics and geopolitical risk. His works have been featured in consultancy firms, think tanks, and media outlets in the U.S., the U.K., India, and Argentina.