Tanzania is facing a fuel crisis, and the world seems to be overlooking it. The fuel price has now gone up by 17% within a short amount of time. Although the Tanzanian government has announced a cap on the cost of the oil, the initial shock has still led to a price surge in transportation.

The National Oil Producer Association has stated that it has predicted the shortage since January, blaming the government for the lack of action. While the Tanzanian government blamed hoarders for the petrol shortages, other institutions have pointed to the shortage of US dollars as the leading cause of the fuel crisis.

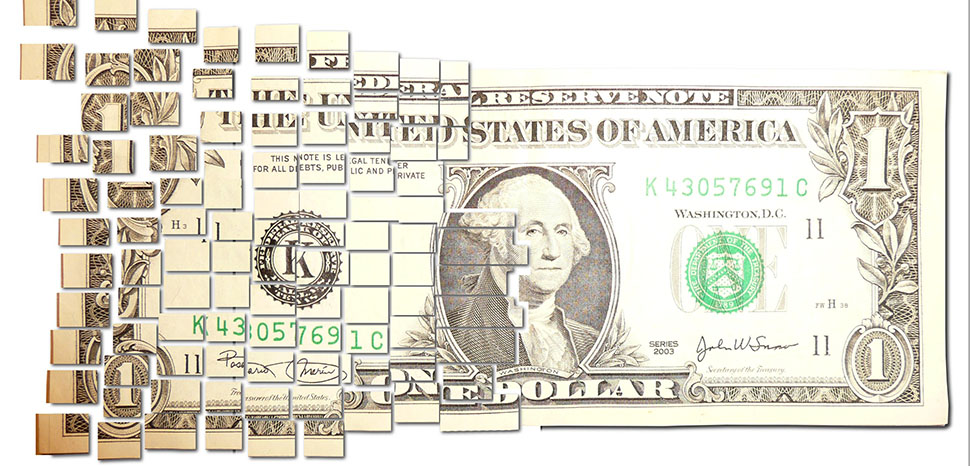

In reality, the fuel crisis is a story foretold. Moreover, it’s one that reveals a long-lasting US dollar shortage in Tanzania. A massive trade deficit and the growing international debt have put upward pressure on the Tanzanian government’s spending. Meanwhile, the rising value of the US dollar has put the government in an even more vulnerable position. As a result, with increasing prices worldwide, the Dodoma government has to dig ever deeper into its pocket to cover the nation’s expenses.

Trade Deficit and Debt

The shortage of US dollars did not happen overnight. Tanzania’s trading structure is making the financial situation of the Dodoma government more vulnerable. Imports are worth more than 17% of the Tanzanian GDP, while exports fall well behind imports. Tanzania’s trade deficit was $4.4 billion in 2021, while the foreign currency reserve was $6.3 billion. Thus, the country continues to experience a tight balance in foreign trade.

Import demand is particularly apparent in the fuel industry. Although Tanzania and nearby Uganda have oil and natural gas resources, Tanzanians still have to import fuel from other countries due to a lack of infrastructure. UAE and Saudi Arabia are both major Tanzanian trade partners. Last year, Tanzania imported more than $2.2 billion US dollars’ worth of fuel.

Tanzania’s debt structure is also alarming. As Tanzanian debt levels rose significantly last year, the stress of paying back these debts also ramped up. The debt level is expected to grow further as the government takes on new major infrastructure projects. The Bank of Tanzania reports that two-thirds of its debt is in US dollars. While Tanzania’s debt level is 40% of its GDP, a relatively safe level, the predominance of US dollar-denominated debt will continue to act as a major drain Tanzania’s foreign reserves.

US Dollar Outflows

Apart from the country’s massive trade deficit, rising interest rates in the United States and ongoing capital outflows have compounded the problem of US dollar shortages in Tanzania. The Federal Reserve’s long period of rising interest rates has made the US dollar appreciate in international markets. More dollars are now flowing back to the US, which creates downward pressures on other currencies. Moreover, the circle of rising interest in the United States is far from over, with the Federal Reserve planning to increase interest rates again this year. The appreciation of the US dollar and the relative depreciation of the other currencies can thus be expected to continue.

Tanzania is no exception. The Tanzanian shilling remained at a stable exchange rate of 2,300 for over two years. However, the exchange rate jumped from 1 US dollar to 2,500 Tanzanian shillings. While Tanzanian exports do not generate enough foreign exchange and the country mostly relies on imports of critical items, the US dollars will keep flowing out of Tanzania en mass, and these outflows will remain a challenge to the Tanzanian economy overall.

Rising Prices

Global market prices have also skyrocketed since the pandemic, contributing further to Tanzania’s dollar shortage. The shutting down of the worldwide supply chain and the ongoing war between Russia and Ukraine has made the price of grain to manufactured goods substantially higher. The rapid decline of Tanzania’s forex reserves is an example of the increasing expenditure of the nation.

Rising prices also hurts production in Tanzania. The country heavily relies on imported fertilizer and machinery to manage its agriculture. Due to the Ukraine war, the international fertilizer supply has become unstable while prices have also jumped. Agriculture remains Tanzania’s leading industry, with most exports being raw agricultural products. Rising prices also raise the cost of Tanzania’s exports, thus further damaging its international income.

Impact of the Dollar Shortage

The dollar shortage may play out on a macroeconomic level, but the implications are quite apparent on the ground. According to Tanzanian fuel traders, the country has imported 24% less fuel in the first eight months of 2023 compared to last year. This decline is due mainly to the lack of US dollars. For everyday life, as Tanzania heavily relies on land transportation for cargo, the dollar shortage and the fuel crisis are driving living expenses up for ordinary people.

The Bank of Tanzania has also recognized that due to the appreciation of the US dollar, debt levels grew significantly last year. Although Tanzania’s primary borrowers are international organizations and the loans are usually small or carry no interest, a US dollar shortage and an appreciating US dollar could further deteriorate Tanzania’s ability to pay back its loans, especially in the private sector.

Besides putting a cap on the oil price, the government has taken other actions to address the dollar shortage. The Bank of Tanzania has issued letters of credit to the oil companies to purchase oil. Meanwhile, the Tanzanian government has also cracked down on unregistered foreign exchange services while limiting withdrawals in US currency.

The ongoing economic crisis in Tanzania stands as a warning for other African states faced with similar outlooks. Many countries share similar economic structures and heavily rely on imports. Skyrocketing international prices combined with US dollar outflows carry similar risks for these countries. There have already been fuel shortages in Kenya and Malawi, driven by similar factors.

The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.