The Federal Reserve reveals the outcome of its latest meeting today, including revised economic outlooks and a new ‘dot plot’ survey of future rate hikes.

Though the prospect of a rate hike is still on the distant horizon, with the vast majority of those polled in the previous dot plot envisioning increases starting in 2023, the matter of winding down the Fed’s unprecedented COVID-19 monetary stimulus efforts is one of far greater immediacy, with many betting that today’s statement will hint at a bond-buying winddown commencing in November.

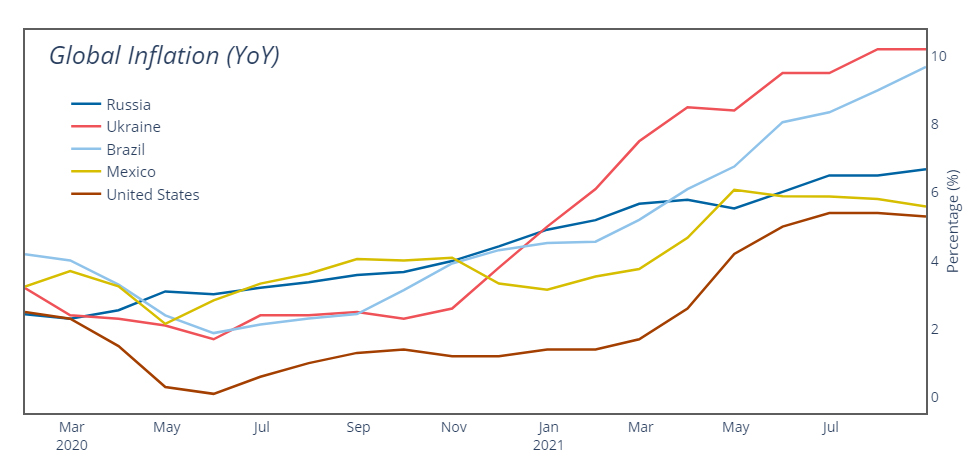

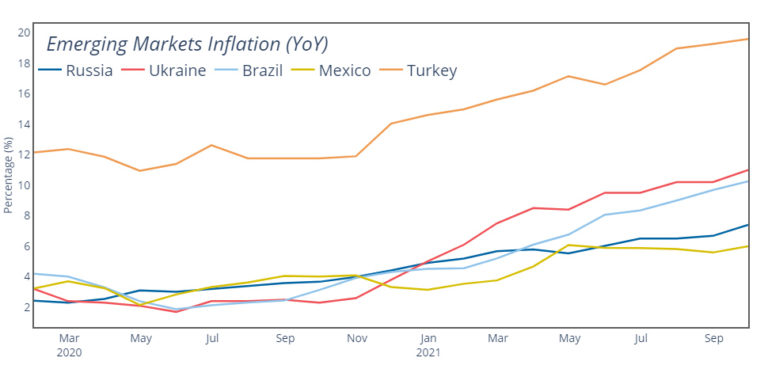

The nature of the Fed’s exit from monetary stimulus represents high stakes for emerging markets, many of which are still grappling with the growth-impacts of the COVID-19 pandemic, particularly those that are highly dependent on service-heavy industries such as tourism. Resurgent inflation has taken hold worldwide, and particularly in emerging markets, some of which have been forced into raising rates far earlier than they would otherwise have liked.

A withdrawal of monetary stimulus is rightly seen as a prelude to rate hikes, and thus both will have the impact of drawing capital out of emerging markets. This in turn risks a downward spiral where interest rates are hiked to insulate capital and dampen inflation at the direct expense of growth. The stakes are made even higher by the ongoing COVID-19 pandemic, which risks a bifurcated global recovery that places emerging markets at a distinct disadvantage vis-à-vis heavily-vaccinated and ‘normalized’ developed economies.

The graphs illustrate how some of these dynamics have been playing out well before the Fed makes its big move (whenever that may be). Brazil, for example, was forced to hike rates right when COVID cases were raging earlier in the year, and more hikes are now planned amid persistent double-digit inflation. Higher rates of course also mean more expensive borrowing during a time of unprecedented debt accumulation around the world. One recent report from the International Institute of Finance found that emerging-market debt hit a record $36 trillion over the first three months of 2021, with recent increases fueled primarily by borrowing in Brazil, Russia, and Korea. The pain could be particularly pronounced for USD-denominated borrowers in the event that tapering produces a US dollar rally against emerging market currencies.

Thus, the taper risks making an already tenuous economic outlook even worse for emerging markets, and not necessarily through any particular fault of the Federal Reserve’s FOMC. We’ve seen it once before in the ‘taper tantrum’ of 2013. However, one could argue that this episode was primarily a matter of market panic and poor signaling. Far more dangerous is the low-grade tantrum that endures, the one that continues to act as an anchor on global growth, not owing to any misunderstanding on the part of investors, but rather a slow and steady accumulation of debt, geopolitical tension, and logistical inefficiencies in the global economy.