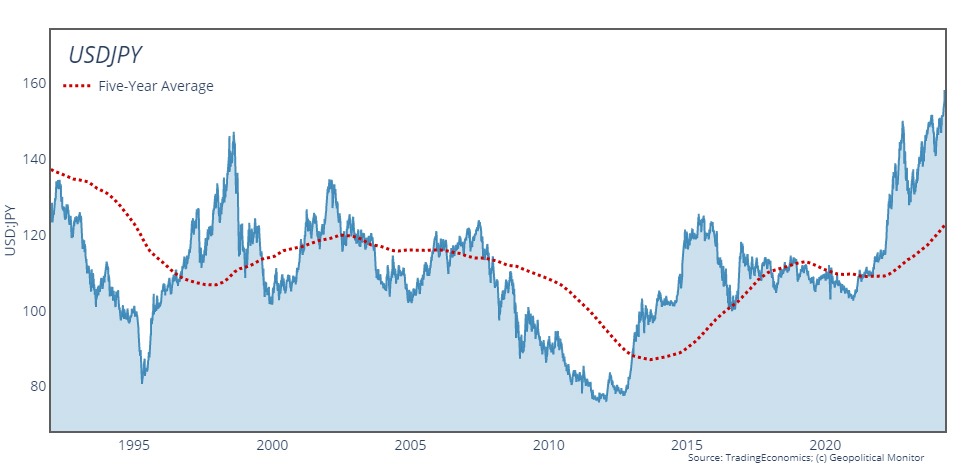

In January 2020, one US dollar netted approximately 107 yen. Today, that number is around 154. Such is the years-long decline of Japan’s currency, fueled by a combination of ultra-low interest rates, quantitative easing, economic stagnation at home, and a policy mantra of active yield control. But the yen’s decline is now accelerating and testing the limits of what policymakers can accept, prompting a series of interventions in currency markets. Is Japan finally starting to test the limits of its low-interest, high-debt economic model?

What’s Behind the Yen’s Weakness?

The yen’s weakness is primarily due to a large interest rate differential between Japan and the United States. While the Federal Reserve has set its benchmark interest rate at 5.25-5.50 percent, the Bank of Japan’s (BOJ) rate remains at just 0-0.1 percent. On a macroeconomic level, such a gap effectively leeches capital away from yen-denominated assets and toward the higher (and perceived safer) gains of USD-denominated assets, namely US Treasuries, of which the 10-year yield is currently hovering around 4.4 percent.