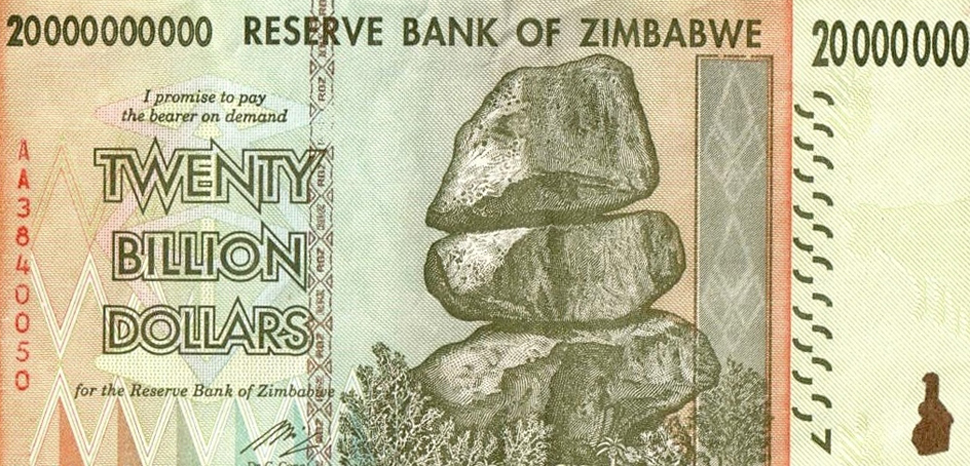

For many Zimbabweans queuing up outside banks last week, it must have felt like the beginning of a new era. A decade after the Zimbabwean dollar was abandoned after falling victim to years of hyper-inflation, crisp new “Zimdollars” once again entered circulation this week. However, this time around the denominations come – at least for now – in two and five dollar bills, instead of the 100 million dollar notes that were printed towards the end of the last Zimbabwean dollar.

This new generation Zimdollar is the latest salvo by the government to combat the physical cash crunch and a crucial step ahead in its currency reforms. The Reserve Bank of Zimbabwe plans to incrementally inject $1 billion into the economy over the next six months, stimulating demand and production in a measured manner while keeping money supply in check.

“We will make sure that we drip-feed the physical cash into the market in order to ensure that there is sufficient cash in the economy,” said central bank chief John Mangudya. “We believe this will also help in eliminating queues at the bank where people spend countless hours of productive time queuing for cash.”

Mangudya added that the new Zimdollar would take the place of existing electronic money, alleviating the fear that the cash injection in the middle of an economic crisis would stoke inflation. Keeping price increases and speculative behaviour in check is also one of the reasons why the Reserve Bank is initially issuing lower denomination notes and coins.

For Zimbabweans, the new cash is a welcome relief. Over the past 10 years, they had to juggle a multitude of currencies and proxies. Following the collapse of the old Zimbabwean dollar in 2009, a basket of currencies became legal tender in the country, from the US dollar to the Chinese yuan. By 2015, the foreign currency notes dried up at the banks, which started a chronic cash shortage in Zimbabwe. The central bank introduced bond notes as a surrogate currency, but black market speculation quickly eroded their value, which then triggered the creation of electronic notes.

Given Zimbabwe’s disastrous state of affairs, a popular uprising ensued against the country’s long-time strongman Robert Mugabe, leading to his resignation two years ago. He was replaced by Emmerson Mnangagwa, who then won the presidential election in July 2018. He inherited a struggling economy marked by hyperinflation, cash shortages, a budget deficit, endemic corruption and a lack of monetary sovereignty.

Promising wide-ranging reforms, Mnangagwa appointed Mthuli Ncube as Finance Minister, a respected economist who was a professor of Public Policy at Oxford with a PhD in Mathematical Finance from Cambridge University. Mnangagwa tasked him to stabilise and transform the Zimbabwean economy so that it could achieve upper middle-income status by 2030, in line with countries such as Russia, China, Thailand, Costa Rica, Turkey and Malaysia (in fact, Zimbabwe was upgraded by the World Bank from a low income to lower middle income country in July).

Facing large fiscal deficits due to the expansion of underground economic activity and the sanctions imposed on Zimbabwe during Mugabe’s rule – which restricted access to U.S. dollars – Ncube launched the Transitional Stabilisation Programme (TSP) a year ago with far-reaching currency and structural reforms. The move was endorsed by the International Monetary Fund (IMF), with whom Zimbabwe signed a two-year monitoring programme that could earn it debt forgiveness and future financing.

In February this year, the government introduced the so-called Real Time Gross Settlement (RTGS) dollar and abandoned its multi-currency system four months later. By now, most Zimbabweans had resorted to mobile money, which became an integral part of the country’s payment system. But it too had its challenges, as wallet holders had to pay premiums of up to 50% to price-gouging mobile money agents to access their funds in cash. This contributed to the rapid depreciation of the currency and compounded the cash shortage. This week’s issuance of the physical Zimdollar bills aims to alleviate that problem, as the availability of cash will eliminate the extortionate premiums incurred when transacting through mobile money.

The new currency likely faces an uphill battle. But the government is confident, urging Zimbabweans to embrace the freshly minted bills and coins to ensure they find traction in the market. Leaders from politics, business and civil society need to play their part as well, shedding their differences and quarrels and rally collectively behind the Zimdollar.

Its roll-out comes at a critical time for the government’s reform agenda, coinciding with the presentation of Zimbabwe’s 2020 budget, which revolved around enhancing productivity, growth, competitiveness and job creation, and the passing of the Maintenance of Peace and Order (MOPA) bill, which replaced a controversial emergency law that dated back to the Mugabe era, a key demand by the U.S. government to remove sanctions.

Implementing reforms – especially after decades of mismanagement – is a painful process and Zimbabweans are tired. But with political will tangible results are gradually being achieved. The country may be on the cusp of a better future, finally putting the years of isolation behind it. Perseverance and collaboration will help to ease the way.

The views expressed in this article are those of the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com or any institutions with which the authors are associated.