The post US Shale Resilience Puts Pressure on OPEC+ appeared first on Geopolitical Monitor.

]]>Last year, US crude oil production reached a record high of 4.1 million barrels per day (bpd), underscoring the country’s increasing role as a significant oil exporter. This uptick in production and exports has enabled the United States to penetrate markets in Asia and Europe, traditionally held by OPEC+ members. The exploitation of shale reserves in areas like the Permian Basin, based in the state of Texas, have been central to American export growth. Shale oil is prized for its light density and low sulfur content, which is desirable for refineries as a cheaper alternative to heavier and sour crudes produced by Canada, Mexico, and the Gulf region.

The post US Shale Resilience Puts Pressure on OPEC+ appeared first on Geopolitical Monitor.

]]>The post Is Azerbaijan a Friend of the West? Take a Closer Look appeared first on Geopolitical Monitor.

]]>From the perspective of American and European politicians with an appetite for imported hydrocarbons and black caviar, Azerbaijan is a valuable Western ally. It supposedly provides leverage against Russian and Iranian influence in the Caucasus and is frequently mentioned as a friend of Israel, supplying that country with approximately 60 percent of its oil in exchange for weaponry to fight Armenians.

Too often overlooked in this calculus is a complex web of relationships between the Azerbaijani regime in Baku and the rulers of Russia and Iran.

Azerbaijan’s relationship with Russia is the most obvious and damaging part of this web. Baku entered a strategic partnership with Moscow, marked by an “Allied Relations” Declaration in February 2022, just two days before Russia invaded Ukraine. This alliance has expanded to include intelligence-sharing and hydrocarbon trade, allowing Azerbaijan to make a mockery of Western sanctions by shipping Russian oil and gas to Europe.

While Azerbaijan’s support of Ukraine’s territorial integrity has at times been loud, the burgeoning financial and political engagements with Moscow have become conspicuous. Azerbaijan is helping Russia evade sanctions and has been one of the top four destinations for Russian oligarchs during the war in Ukraine.

Moreover, the regime in Baku has endorsed Russian mediation efforts between Armenia and Azerbaijan, while rebuffing initiatives from the U.S. and the EU. Baku also has welcomed Iranian mediation based on Tehran’s position that the regional conflicts should be resolved “without the interference of non-regional and Western countries.”

Azerbaijan’s relations with Iran have been strained at times. Tehran has expressed concern for several matters, such as, the use of Israeli-manufactured drones by the Azerbaijani armed forces in the disputed area of Artsakh and the adoption of policies that tolerate or even endorse groups advocating the secession of Northern Iran, home to many ethnic Azeris.

Even so, recent developments show a warming of ties between Azerbaijan and Iran that should worry policy makers in the West and particularly those in Israel. On October 7, 2023, coinciding with Hamas’s brutal attack on southern Israel, Azerbaijan and Iran signed an agreement concerning the so-called Aras corridor. This project, involving construction of a highway and a railroad bridge, is designed to connect Azerbaijan and its exclave, Nakhichevan, through Iranian territory.

The Aras corridor agreement is part of a broader normalization between Iran and Azerbaijan, including critical agreements signed since September 2023. Moreover, there are reports that Iran will invest in territories acquired by Azerbaijan during and after the 2020 war with Armenia. In addition, there has been a notable surge (33 percent during the first nine months of 2023) in the railway trade between Iran and Azerbaijan, and experts foresee further growth in bilateral trade following completion of the Aras corridor.

But this isn’t all. On January 7, 2024, Iran and Azerbaijan finalized an accord pertaining to the construction of the Rasht-Astara railway, aimed at eliminating a longstanding gap within the International North–South Transport Corridor, known as the INTSC. The INTSC—a 7,200-kilometer corridor encompassing road, rail, and maritime routes—connects Russia’s second largest city, St. Petersburg, with the port of Mumbai, India, via Azerbaijan and Iran, bypassing the Suez Canal.

Foreseen as a channel for Russia to circumvent Western sanctions, replace European trade routes, and expand its economic influence in South Asia, the INTSC has attracted the financial support of the Putin regime, particularly evident in the funding of the Rasht-Astara railway project.

The imminent completion of the Rasht-Astara railway is poised to enhance trade among Russia, Iran, and Azerbaijan. Experts predict that the total volume of cargo shipped by rail alone will reach at least 15 million tons per year before 2030.

Azerbaijan’s role as a facilitator will bolster Russia’s position in its war against Ukraine. The INSTC offers immense potential for the Russian economy, providing Moscow with access to crucial trade partners and enabling additional funding for its campaign in Ukraine.

This initiative holds considerable significance for Iran as well, offering a way to evade Western sanctions and establish a direct land connection with Russia, a pivotal ally. The completion of the INSTC is poised to lift Iran out of isolation, transforming it into a major trade hub in Eurasia.

Under the leadership of the Aliyev family, Azerbaijan has since 1993 operated as an authoritarian regime famous for its lack of free and fair elections, suppression of political opposition, and imprisonment of journalists and activists. War crimes and ethnic cleansing committed by the Azerbaijani regime in 2020 and 2023 in Artsakh only add to Aliyev’s list of bad deeds. Baku’s desire to remain an energy partner for Europe and a supplier for Israel is a key part of the regime’s drive to secure internal and external legitimacy.

Western policymakers therefore face a critical question: is it justified to overlook Azerbaijan’s deepening economic and financial ties with Russia and Iran, along with its abysmal human rights record, merely to secure access to Baku’s diminishing oil reserves? The recent resolution of the European Parliament seems to suggest that this is not a trade-off they are viewing kindly.

Continuing relations with Azerbaijan, despite its authoritarian practices, could prove shortsighted for Israel too. It is time for Israel’s intellectuals and leadership to acknowledge the ethical concerns associated with supporting Azerbaijan against Armenia. What may feel right at this juncture must be critically examined to ensure it aligns with what is truly right.

David A. Grigorian is a Senior Fellow at Mossavar-Rahmani Center for Business and Government at Harvard’s Kennedy School and a veteran IMF Economist based in Washington. George Meneshian is an Athens-based policy analyst specializing in the Caucasus and the Middle East and a researcher at the Washington Institute for Defence and Security.

The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.

The post Is Azerbaijan a Friend of the West? Take a Closer Look appeared first on Geopolitical Monitor.

]]>The post Geopolitical Snapshot: Nigeria appeared first on Geopolitical Monitor.

]]>

Nigeria’s geopolitical importance stems from its demographic, economic, and strategic weight. As the most populous country in Africa, with over 200 million people, Nigeria represents significant demographic power via a large domestic market and labor force. Furthermore, Nigeria’s diverse society, which encompasses a wide range of ethnic groups and cultures, places it at the heart of African socio-political dynamics, making it a critical player in efforts toward regional integration and cultural diplomacy.

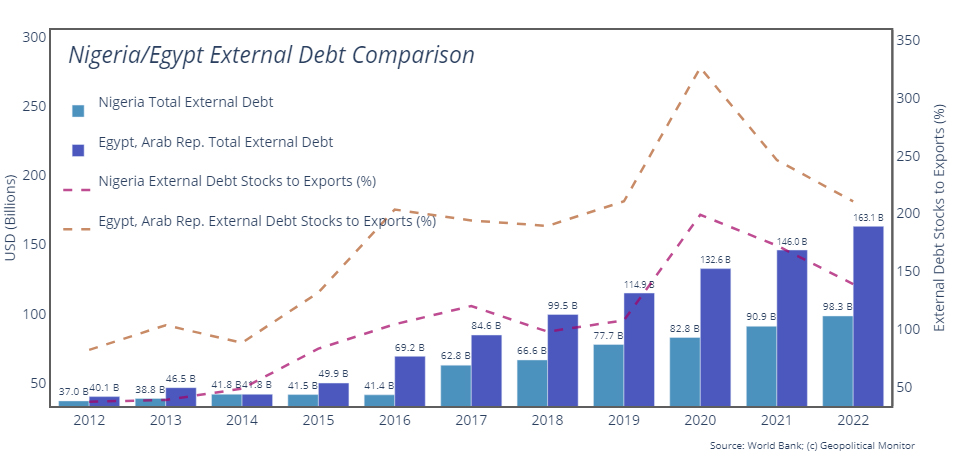

Economically, Nigeria is one of Africa’s largest economies, with its approximately $395 billion GDP among the top three on the continent – higher than Egypt’s $358 billion and just behind South Africa’s $401 billion. The nation’s wealth is largely attributed to its extensive oil and gas reserves, making it one of the world’s leading oil exporters. Strategically, Nigeria’s location on the Gulf of Guinea grants it a pivotal maritime position, controlling crucial shipping lanes with access to significant Atlantic trade routes. This strategic maritime position is vital for international trade, especially for oil exports. Moreover, Nigeria’s role in regional and international organizations, such as the Economic Community of West African States (ECOWAS) and the United Nations, amplifies its influence on regional security, economic policies, and diplomatic initiatives. As a leading contributor to peacekeeping missions in Africa, Nigeria has a substantial impact on the continent’s security landscape. Its efforts in combating regional threats, such as terrorism and piracy, further underline its importance as a stabilizing force in West Africa.

The post Geopolitical Snapshot: Nigeria appeared first on Geopolitical Monitor.

]]>The post Rogun Hydropower Plant Nears Completion in Tajikistan appeared first on Geopolitical Monitor.

]]>Despite overrunning cost issues, the Rogun dam project is essentially a too-big-to-fail operation in a country where over 90% of its electricity comes from hydropower sources.

Tajikistan is a country of about ten million people and is one of the most mountainous countries in the world. Cut through by the formidable Alay and Palmir mountains, the country consists of two major population cores. The primary core is in the country’s southwest on a plain where the capital city Dushanbe sits. This is where much of the country’s agricultural output originates from. The second core is centered around the city of Khujand in the contentious yet fertile Fergana Valley region, which is divided between Tajikistan, Kyrgyzstan, and Uzbekistan. A relic from the Soviet era, by divisively splitting the region between the former Soviet republics, Moscow sought to ensure that no sole power could ever dominate the wider region.

The rugged Tajik terrain means that there are no rail routes linking the two core regions. Only the RB01 highway between Dushanbe and the city of Histevarz serves as any meaningful land route. To the east is the highly mountainous, sparsely populated, and the occasionally restive province of Gorno-Badakhshan.

At present, Tajikistan’s economy is dominated by agricultural and mineral exports. Remittances from Tajiks abroad make its GDP the most remittance-dependent of any country in the world. Growth rates during the past decade or so have almost always been above 6% annually since the year 2000, with the exception of the Great Recession of 2008 and the COVID-19 pandemic. Nevertheless, the country is still relatively poor, managing a GDP per capita of only $1,356, the same level as the years leading up to the dissolution of the USSR. The urbanization rate is low; only about 27% of the country’s population lives in cities. Since the end of its destructive civil war in 1997, the country has managed to rebound, taking about a generation to recover.

Decades in the making, the hydroelectric plant near the city of Rogun is set to have its third and final generator online by the end of 2025. The coronavirus pandemic put a halt to bringing that third generator online until concrete started pouring in July of 2022. The Rogun Dam will also be the largest power plant in the country at 3600 MW. According to the IEA, Tajikistan has the potential for up to 527 terawatt hours of power, only 4% of which is currently being harnessed. When the final generator comes online, the total capacity of the country’s electric power system will increase by more than 50% compared to when the dam was not even partially operational.

Naturally, this has economic consequences for both Tajikistan and its neighbors. Tajikistan needs energy to fuel its growing industrial sector. Increased excess capacity from its hydropower network means that more power can be exported to neighboring countries like Afghanistan and Kyrgyzstan.

With its hydropower potential, Tajikistan could soon be a major energy producer allowing it to punch above its weight in regional geopolitics. The benefits to Dushanbe in this area outweigh the exorbitant costs of the Rogun dam project.

The post Rogun Hydropower Plant Nears Completion in Tajikistan appeared first on Geopolitical Monitor.

]]>The post Soy Prices Slip from Post-Pandemic Highs appeared first on Geopolitical Monitor.

]]>

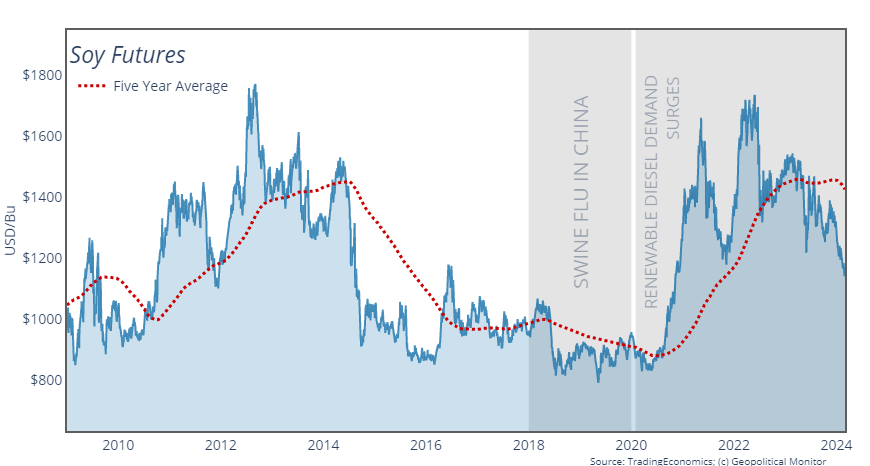

As one of the world’s most traded commodities, soybeans are a critical feature in the global agricultural landscape. Movement in soy futures can influence the stability of different countries: shaping trade policies, impacting diplomatic relations, and determining domestic stability through the movement of key input prices. Countries like the United States, Brazil, and Argentina, which are leading soybean producers, often leverage their production capacity as a significant economic asset, affecting global supply chains and price dynamics. On the other side, major importers like China, whose massive demand for soybeans stems from its vast hog sector, view soybean imports through the geopolitical lens, ascribing the commodity critical importance for food security and agricultural policy. This geopolitical significance was evident during the US-China trade war, as soy was one of the first commodities targeted for sanctions in 2018.

The post Soy Prices Slip from Post-Pandemic Highs appeared first on Geopolitical Monitor.

]]>The post Geopolitical Snapshot: Pakistan appeared first on Geopolitical Monitor.

]]>

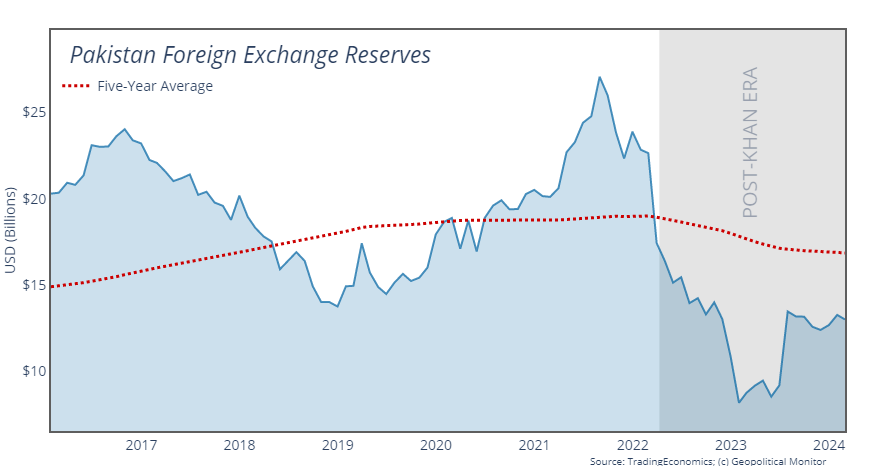

Though it has yet to realize its economic promise, Pakistan more than makes up for this in military and diplomatic weight. The country is home to a sizable and overwhelmingly young population of over 240 million people, the fifth largest in the world; it boasts a modern and well-funded military, armed with nuclear weapons; and it borders key countries like India, China, Iran, and Afghanistan. The authorities in Islamabad, whether political or military, are also frequently involved in various internal and external conflicts, ranging from the rise, fall, and re-rise of the Taliban to cross-border Baloch separatism and India-Pakistan tensions.

The post Geopolitical Snapshot: Pakistan appeared first on Geopolitical Monitor.

]]>The post Al-Durra Field: Another Front for Regional Tensions with Iran appeared first on Geopolitical Monitor.

]]>In October 2023, Kuwait’s Minister of Petroleum Saad Al Barrak stated that the Al-Durra field is considered one of the most important targets of the Kuwaiti government work program, and earlier in July 2023, Minister Al Barrak stated that Kuwait and Saudi Arabia have the “exclusive rights” to the field. In this respect, In 2022, a Kuwaiti-Saudi Arabian agreement was already signed in order to develop Al-Durra field, allowing for the production of 1 billion cubic feet of gas equally between both nations.

Iran on the other hand has criticized the agreement, decrying it as illegal. Iran advances the claim that 40% of the field falls within its maritime border, despite its failure to demarcate its maritime borders in this region. Regardless of Iran’s claims and criticism against KSA and Kuwait, the Gulf Cooperation Council (GCC) ministerial meeting stated last Sunday that Al-Durra gas field in its entirety is jointly and “only” owned by KSA and Kuwait, as reported by the Saudi state news agency. This has prompted Iran’s Foreign Ministry Spokesman to reject the statement issued by the GCC ministerial meeting, depicting it as “unconstructive.”

Iran has long sought to expand its influence in the Middle East, with destabilizing consequences over the past three decades. The Al-Durra field presents an obvious opportunity for Iran in the prospect of gaining control over a valuable energy resource. In securing access to just 40% of such a major gas field, Iran could enhance its energy security and boost its economic capabilities, thereby increasing its political and strategic influence in the region. Since Iran also views GCC states as the enemy-of-its-enemy in Washington, rising tensions over the Al-Durra field presents Iran with another opportunity to directly challenge the GCC as well, and by extension US interests in the region. In the same vein, the situation invites external powers such as Russia, to support Iran in its endeavours towards its claims ithe Al-Durra field.

The developing tensions in the Arabian gulf will produce three critical tests. Firstly, it will test the extent of the success of the relations normalization agreement between KSA and Iran, which took place in March 2023 under Chinese mediation. Secondly, it will test the extent of Chinese influence in the Middle East and how China may seek to establish an equilibrium in Iran’s tensions with other regional players. This is of particular interest given that China is already the main trade partner for Iran and seeking to increase its economic footprint in the GCC and the broader Middle East. However, China’s influence in the Middle East is already being limited in the context of the war in Gaza, civil war in Sudan, and the threat posed to international maritime safety by Iran-backed Houthis in Yemen. Thirdly, it will test the extent of the contemporary US strategic commitment to the Middle East.

For decades, the US has proved to be the strategic defense, security, and economic partner to most of the countries in the Middle East, especially the GCC nations. Furthermore, as the Houthis threat to shipping routes in the Red Sea emerged, the US was the first nation to take a proactive response by launching the US-led operation “Prosperity Guardian,” aimed at countering Houthi attacks on commercial vessels and degrading their attack capabilities. On the other hand, China has not offered to take any role or extend support to the operation, which is primarily aimed at protecting commercial vessels regardless of their origin.

Thus, rising tensions between Iran and KSA-Kuwait around Al-Durra provides the United States with an opportunity to further cement its strategic engagement in the Middle East. This can take place on multiple fronts including but not limited to further enhancing its defense and security cooperation and domestic capability building with regional Arab partners, which will collectively increase deterrence against any possible aggression from Iran as a result of the rising tensions over the Al-Durra field.

The Al-Durra field is a significant point of contention in the Gulf region, with Iran, KSA, and Kuwait competing for control. The competition for access and exploitation of the gas reserve is influenced by a complex interplay of economic, political, and strategic interests, which could potentially escalate existing rivalries and contribute to further instability in the region. It is crucial for all parties involved to participate in diplomatic dialogue and cooperate to address developing tensions and prevent any escalation that risks negative consequences for the entire region.

The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.

The post Al-Durra Field: Another Front for Regional Tensions with Iran appeared first on Geopolitical Monitor.

]]>The post A Neutral Ukraine Is Not the Answer appeared first on Geopolitical Monitor.

]]>Ukraine is not exactly a stranger when it comes to the notion of neutrality. In the aftermath of the fall of the Soviet Union, the country expressed an intention in its declaration of state sovereignty of 1 July 1990 to become a permanently neutral state that would shun participation in military blocs and show a commitment to denuclearization. This largely nonaligned status resulted in a vacillating foreign policy, which nonetheless appeared to be conducive to the pursuit of amicable relations with both the European Union (EU) and Russia, before being ultimately abandoned in December 2014 in the aftermath of Russia’s annexation of Crimea and the start of the Donbas war. In February 2019, with the overwhelming approval of the Verkhovna Rada (the Parliament of Ukraine), the Ukrainian constitution was amended, setting the country on a course toward full membership in the EU and NATO. Nonetheless, in late March 2022 Ukrainian president Volodymyr Zelenskyy was still prepared to discuss the possibility of Ukraine taking a neutral position as part of a potential peace deal with Russia to halt the invasion.

Yet there are quite a few practical and moral reasons as to why the train of neutrality should now be considered to have long left the station.

Neutrality, which remains a somewhat imprecise concept and was famously characterized in 1956 by former American Secretary of State John Foster Dulles as an “obsolete conception,” may be regarded as a state of mind or a normative self-conceptualization of the political elite and the citizens, rather than a status that a country is bound to by balance of power considerations. Arguably, the more nuanced understanding of neutrality is even more relevant in the case of consolidated democracies. Public support for Finland joining NATO (the country officially became a member on 4 April 2023) rose from approximately 33% of Finns in 2018 to close to 80% of Finnish citizens in 2022, which was clearly a significant factor when it came to the decision taken by the country’s political establishment to submit a membership request in May 2022.

Ukraine is certainly on a path towards becoming a full-fledged democracy, as a result of which any decision to either adopt neutrality or stick to an explicitly pro-Western geopolitical course needs to reflect the wishes of the general population, which are not set in stone and will not in any way be compatible with the narrow definition of Ukrainian neutrality that is likely to be put forth by the negotiators on the Russian side.

What Russian policymakers do not seem to fully realize is that the Russian troops’ actions in Ukraine have unleashed what could be described as a generational hostility directed not only toward the Russian elites but also toward the Russian people themselves, which has also had implications beyond the realm of politics. In Croatian historian Domagoj Krpan’s words, this internecine war may become the founding narrative when it comes to building a new Ukrainian national identity in the 21st century. Assuming some form of neutrality is essentially forced upon Ukraine, a de jure neutral Ukraine will continue to instinctively gravitate towards the West, will be unwilling to perceive itself as a bridge between the Occident and the “Russian world”, and will inevitably evaluate its foreign policy options through an anti-Russian prism, for instance when it comes to the manner of its voting on United Nations (UN) General Assembly resolutions.

Given that many neutral countries such as Switzerland maintain capable armed forces with a full readiness for engaging in combat, it would be quite unrealistic, even if ironclad security guarantees are provided to Ukraine by Western actors, for Ukraine to be expected to scale down its military forces to the extent that the country would remain virtually without a standing army. Thus, it is difficult to see how, especially with trust between Russia and the West being in even shorter supply than before, a solemn proclamation of Ukrainian neutrality coming from the Ukrainian government and the main Western countries supportive of Ukraine (unless it occurs at a time when the Ukrainian military has been reduced to a shadow of its current strength) would satisfy one of the conditions still insisted upon by Russia for ending the invasion, namely “demilitarization.”

In contrast to previous instances in which a neutral status was essentially imposed on a country in a manifestly weaker position than its adversary, the present state of the conflict does not necessitate the adoption of such an approach. For example, unlike in the case of Finnish neutrality during the Cold War, which was not negotiated by the Finns from something approaching a position of strength, but was a way to guarantee Finland’s national existence and security by avoiding invasion or occupation by Soviet forces, Ukraine has already had its territorial integrity blatantly violated by Russia while at the same time it has demonstrated that it can hold its own on the battlefield against the Russian forces and is unlikely to find itself, unless Western support completely dries up, in the desperate position of having to sue for peace. Thus, a settlement that includes the adoption of a neutral status will not be palatable to the majority of Ukrainian citizens, especially if it does not entail the return to Ukraine of all Russian-occupied territories. The latter prospect does not mesh that well with the current military realities on the ground and continues to be a non-negotiable issue from the perspective of the Putin administration.

From a moral standpoint, requiring Ukraine to declare neutrality is also likely to be perceived by the country’s citizens as a betrayal of them by the collective West, with the latter appearing to bow down to one of the main demands stated by Russia, especially given the enormous personal sacrifices that Ukrainian people have made for advancing the cause of European security. According to a Gallup opinion poll from October 2023, there is already a creeping sense of disillusionment among ordinary Ukrainians with regard to the level of assistance provided by the USA.

Western policymakers should also be cognizant of the reality that neutrality has often been a contrivance of statecraft associated with small states. An adoption of neutrality may be regarded as a failure on the part of the Western countries to properly acknowledge that Ukraine, which prior to 2022 was already considered by a number of scholars to be part of the ranks of the middle powers, is currently yielding vast amounts of soft power and has actually contributed (courtesy of its ability to define regional and global agendas) to elevating the status of other middle powers in international relations. Political realists such as John Mearsheimer have criticized the USA for desiring, by relying on sanctions and other punitive measures, to knock Russia out of the ranks of the great powers. However, Russia’s own culpability (since the late 2000s) with respect to fomenting justifiable concerns among many of its neighboring countries due to the former’s actions weakening the norm of state sovereignty cannot be ignored. On the other hand, symbolically relegating Ukraine (through no fault of its own) from the status of a middle power to that of a small state by requiring it to adopt neutrality would constitute a misreading of the changing dynamics within the international system and would also represent an implicit admission on the part of the West that Ukraine does not deserve to have the same agency as that of the great powers, including those of them that are not averse to engaging in gross violations of the principles of international law.

The importance of (perceived) agency is not to be underestimated because while Ukrainian neutrality could theoretically go hand in hand with a potential membership in the EU, it may become an additional stumbling block by making the country’s future accession, already viewed in a somewhat lukewarm fashion by Germany and France, an even less attractive proposition. For instance, since the launch of Permanent Structured Cooperation (PESCO) in defense at the end of 2017, the EU has become more active when it comes to military matters, but some of the neutral EU member states have not been able to make full use of the new opportunities afforded for military cooperation. Ukraine has already displayed increased interoperability with many EU countries that are also members of NATO, so being forced to opt out of common military initiatives due to a formal commitment to neutrality would be rather counterproductive with regard to both Ukrainian and EU security interests.

Even the most politically astute analysts are finding it difficult to forecast how the conflict in Ukraine will eventually end. What is virtually certain is that the (re)emergence of a neutral Ukraine should be regarded as one of the least viable scenarios, and one that will not be helpful in terms of firmly placing the country in the Western camp, where it belongs.

The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.

The post A Neutral Ukraine Is Not the Answer appeared first on Geopolitical Monitor.

]]>The post Bolivia Aims to Break into Rare Earths Market appeared first on Geopolitical Monitor.

]]>

What We Know

Minister Quispe explained that the Bolivian Mining Corporation (Corporacion Minera de Bolivia: COMIBOL) and the Geological Mining Service (Servicio Geologico Minero: SERGEOMIN) have located REE deposits in Independencia (Cochabamba), San Luis, Cotaje, (Potosí), San Javier and Cerro del Mutún (Santa Cruz). Additional surveying in Cerro Manomo identified 850 REE samples, while Rincón del Tigre had 799 confirmed samples of REEs, both locations are in the Santa Cruz department. The Bolivian La Razon newspaper added that Bolivia has deposits of 17 types of REEs.

“We have two elements, scandium and yttrium, and other elements. We have prospected and explored Cochabamba in the Independencia province: uranium, titanium, and others were identified. Then, in San Luis in Potosí, [prospecting will seek] cobalt and copper,” Minister Quispe said. “Other projects include San Javier, in Santa Cruz, for exploring and prospecting for tantalum and niobium. Also, at Manomó Hill, for uranium and thorium deposits,” added the newspaper Ahora el Pueblo, noting that future exploration will occur in Rincón del Tigre and Mutún for manganese.

The post Bolivia Aims to Break into Rare Earths Market appeared first on Geopolitical Monitor.

]]>The post The Race for Infrastructure Dominance Comes to Africa appeared first on Geopolitical Monitor.

]]>With $10 trillion in assets, BlackRock dominates Wall Street. The world’s biggest asset manager now aims to expand its presence significantly in infrastructure investments, including airports, bridges, oil pipelines, and other sectors. The asset manager is making a significant investment in infrastructure, a financial strategy involving the investment, acquisition, and management of assets such as tunnels, highways, and oil and gas networks. This approach has gained traction in recent decades, driven in part by consistent long-term returns. Governments facing financial constraints have increasingly turned to private funding for projects like fiber broadband, data centers, green energy initiatives (aligned with BlackRock’s focus on climate-related assets), as well as enhancements to airports and roads.

The post The Race for Infrastructure Dominance Comes to Africa appeared first on Geopolitical Monitor.

]]>