The post Winners and Losers in the Greenback Rally appeared first on Geopolitical Monitor.

]]>The post Winners and Losers in the Greenback Rally appeared first on Geopolitical Monitor.

]]>The post Can Blockchain Revolutionize Commodities Trading? appeared first on Geopolitical Monitor.

]]>Such unknowables have existed for as long as commodities have been traded. But technology is now intervening to disrupt convention, paving the way for new and ultimately more sustainable paradigms. Asset tokenization via blockchain technology specifically holds out the promise of revolutionizing supply chains by disclosing the mine source, chain of custody, and ESG practices of a given commodity. This information is a game-changer for consumers looking to make informed purchasing decisions: the graphite in their smartphones will finally be able to tell its story.

Technology alone is not enough; traders, investors, and consumers must be able to put it to good use. What’s needed is for companies to step up and bridge the gap. One notable example is Savala, which has partnered with DComm Blockchain to launch an innovative trading platform that will initially focus on premium graphite before expanding into other commodities. Transactions on the platform will be facilitated via the DComm Blockchain Coin ($DCM), marking a leap forward in the marriage of digital currency and commodity trading. But unlike cryptocurrencies, which tend not to be backed by any hard assets, every token will represent one ton of graphite.

This novel approach can help alleviate longstanding issues in the commodity trading space. For one, it allows grassroots investors to engage directly in commodity markets for the first time, thus encouraging the democratization of a market that has historically been dominated by elite interests. Two, it provides a level of transparency hitherto impossible for traders and investors, opening the door to better investment decisions. For example, investments can be guided by a sense of social responsibility (purchasing from miners with a record of ESG best practices) or geopolitical considerations (purchasing from miners unlikely to be targeted by sanctions). And most importantly, trading portals can act as a conduit for ESG-minded miners to raise capital, linking them up with publics that had previously lacked the opportunities and technological means to invest in commodities on their own terms. Commodity traders also benefit from improved price discovery since portals can help pull the curtain back on the opaque and top-heavy arena of privately traded commodities. End users such as auto OEMs can leverage this price discovery to hedge or even buy necessary inputs directly.

It’s no coincidence that Savala has opted to focus on the premium graphite market, as the commodity exemplifies many of the pitfalls of the status quo. In terms of its importance, there can be no question – as a durable and excellent conductor of heat and electricity, graphite finds its way into all manner of industrial and consumer products. Chief among them, at least in the context of the global energy transition, is lithium-ion batteries, which are expected to propel graphite demand to new heights over the coming years. Yet sources of this highly strategic commodity remain restricted to jurisdictions that carry significant geopolitical or ESG risk. China, for example, accounts for 65% of global graphite production and 90% of global refining, but its government instituted export curbs in late 2023 citing national security concerns. Rights organizations have expressed concern about Mozambique, the world’s second-largest graphite producer at approximately 13% of global output, where local livelihoods and ecosystems have allegedly been upended by large-scale mining. In particular, nearly all graphite mining takes place in Cabo Delgado province, home to a bloody and ongoing insurgency that has caused thousands of deaths.

In light of these supply chain issues, it comes as no surprise that Western governments are scrambling to secure new avenues of graphite production and refining capacity. The Savala portal can assist in the effort by tapping into new sources of capital and channeling it toward responsible operators. Amid a global energy transition at a critical time, the stakes couldn’t be higher. But for the first time in human history, we can at the very least hold out hope for a commodity boom that leaves the planet in a better state than what it found it in.

Richard Garner has acted as an advisor to Savala Global. The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.

The post Can Blockchain Revolutionize Commodities Trading? appeared first on Geopolitical Monitor.

]]>The post Sagging Real Estate and Bad Debts: China’s Banking System Risk appeared first on Geopolitical Monitor.

]]>The real estate crisis in China has been characterized by a slowdown in the market and declining property prices, placing financial strain on developers and homebuyers alike. Evergrande, the country’s largest developer, was ordered to liquidate last year after missing two years of payments on its $300 billion in debts. Similarly, Country Garden slipped into default while carrying approximately $187 billion in liabilities. About two-thirds of the remaining real estate developers have already defaulted or are facing defaults on upcoming payments. This downturn has direct implications for the banking sector, as real estate loans account for a quarter of bank loan portfolios. If the market continues to slump, defaults on these loans could jeopardize the stability of financial institutions.

The post Sagging Real Estate and Bad Debts: China’s Banking System Risk appeared first on Geopolitical Monitor.

]]>The post Past Is Precedent as Xi Struggles to Fix China’s Economy appeared first on Geopolitical Monitor.

]]>Considering China’s growth trajectory leading up to the pandemic, it was anticipated that the country’s GDP would surpass that of the United States by 2035. However, due to slower growth, escalating mismanagement under Xi, and a mounting demographic crisis, it may take several decades before the Chinese economy outpaces the United States, and there’s a possibility it may never do so.

Over the past year or more, manufacturing activity in China has experienced a downward trend, coupled with a decrease in factory gate prices. Although the Purchasing Managers Index (PMI), a gauge of industrial activity, has shown some recovery since the start of 2024, factories are still cutting jobs.

Consumer spending shows little sign of improvement. Additionally, over the past three years, the Chinese stock market has witnessed a loss of $6 trillion in value. Local governments are grappling with mounting debt and potential insolvency, prompting some to halt construction and infrastructure investment. The real-estate market is edging toward crisis levels, with 50 of the leading developers facing potential insolvency. Unfinished construction projects number in the millions of units, leaving homebuyers to contend with the loss of their life savings.

China posted a respectable GDP growth rate of 5.2% last year; however, when adjusted for falling prices, the real growth rate is likely lower. This adjustment factors in the impact of deflation, which could diminish the actual increase in economic output. Furthermore, even a revised growth rate, which has been adjusted downward, is partially attributed to a short-lived surge in consumption following the lifting of COVID restrictions.

Despite a population decline of two million people, youth unemployment remains high. Similar demographic declines are being experienced by other countries, including most of Europe, Japan, and other parts of the developed world. However, the distinction lies in the fact that those countries were already wealthy, with mature economies, before birth rates began to fall. In contrast, although China ranks as the second-largest economy in terms of GDP, it ranks 72nd in terms of nominal GDP per capita. The average Chinese citizen only earns approximately $12,500 per year, which falls below the poverty line in many developed countries. Surprisingly, 75% of the middle class only earn between $10 and $20 per day.

For nearly a decade, Xi Jinping has expressed a desire to shift China from a manufacturing and export-driven economy to one fueled by domestic consumption. However, this vision has yet to materialize due to citizens’ reluctance to spend in China’s struggling economy. Recently, he has been advocating for the New Productive Forces model, aiming to drive economic growth through innovation and new technologies. Technologies like AI could potentially modernize China’s industrial sector, boosting worker productivity and enhancing the competitiveness of Chinese exports. Premier Li Qiang has hailed this shift to New Productive Forces as a “new leap forward,” but it is actually a step backward, as it would mean reverting China to a factory-driven, export-dependent economic model.

Like the other slogans under Xi’s leadership, such as the ‘Chinese Dream,’ ‘Common Prosperity,’ and ‘Dual Circulation,’ the concept of New Productive Forces lacks substantive detail, and the methods by which the CCP intends to achieve this goal remain unclear. However, it is evident that, alongside a return to export-led growth, New Productive Forces will involve government subsidies. This expansion of the government’s role in the economy diverts resources from citizens and public services, potentially hindering consumption. Moreover, prioritizing New Productive Forces could divert attention from addressing systemic issues, such as the real-estate crisis and potential banking crises resulting from defaults in the real-estate sector.

China has traditionally relied on increasing government control during times of crisis, but there are several more constructive measures Xi could consider. He could establish a stabilization fund to bolster struggling equity markets and have unfinished properties taken over by the government to ensure completion, thereby safeguarding buyers from financial losses. Restructuring local government debt and implementing a stimulus program to boost consumer spending are also viable options. Additionally, increasing the social safety net for the elderly could alleviate the burden on working individuals and encourage middle-class spending rather than retirement saving. Revisiting the official retirement age, currently set at 60 for men and 55 for women, is another possibility. However, Xi has yet to pursue any of these avenues.

Going by Xi Jinping’s track record, however, it appears unlikely that he will enact a significant stimulus package or embark on structural economic reforms.

The post Past Is Precedent as Xi Struggles to Fix China’s Economy appeared first on Geopolitical Monitor.

]]>The post Hot US Inflation Report Puts Fed Easing Plans in Doubt appeared first on Geopolitical Monitor.

]]>- The latest US inflation data has surprised on the upside, delaying any plans by the Federal Reserve to cut rates.

- Higher-for-longer interest rates will put pressure on US consumers, who have been piling on credit card debt through 2023.

- There is historical precedent of a twin-peaked inflation crisis in the 1970s.

The latest CPI and PPI inflation data come at a critical juncture for the US Federal Reserve. On the one hand, the US stock market was recently hovering near all-time highs and jobs data shows no signs of retreat from a 3.8% unemployment rate. On the other hand, the March data shows that inflation remains well off the Fed’s 2% target and continues to trend in the wrong direction. Moreover, inflation remains a major political issue with elections looming in November: a recent Gallup poll found that cost-of-living was the foremost concern on the minds of voters.

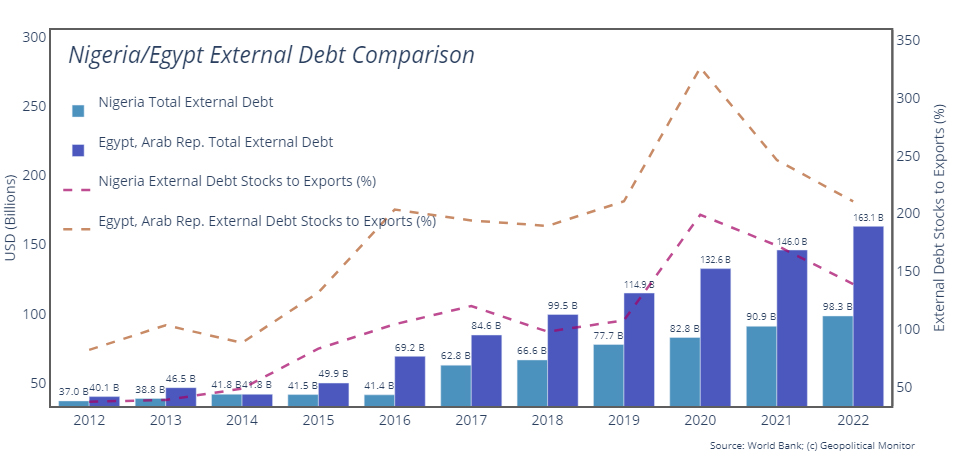

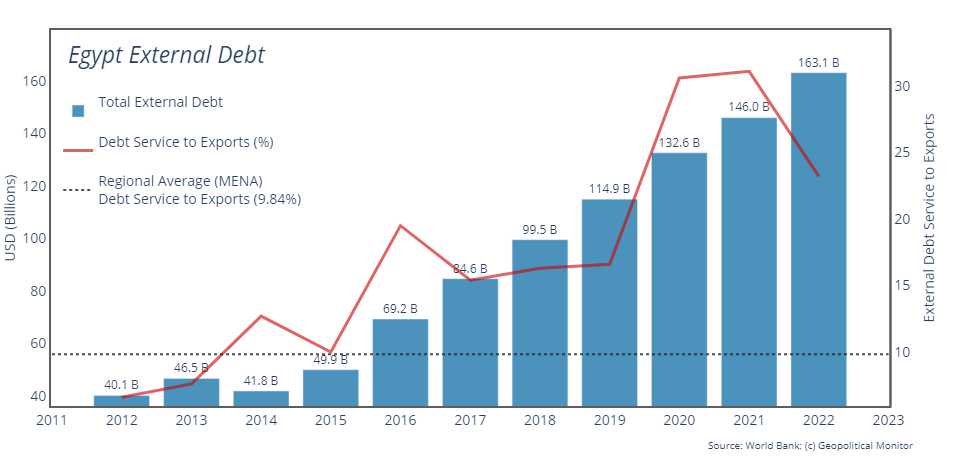

The data, with CPI surprising on the upside and PPI on the downside, will complicate the Fed’s path to easing, and many are now betting heavily against a cut in the Fed’s June meeting. The Fed will be under pressure to adopt an aggressive anti-inflation stance through to November at the very least – a policy that translates into higher interest rates and a stronger US dollar. These monetary forces will also resonate outside the borders of the United States, inducing capital flight from emerging markets and increasing the servicing costs of debt-distressed states.

The post Hot US Inflation Report Puts Fed Easing Plans in Doubt appeared first on Geopolitical Monitor.

]]>The post China’s Economy Turning a Corner? appeared first on Geopolitical Monitor.

]]>One event framed the political context of the first half of 2023 more than any other: the abrupt end of China’s zero-COVID policy. The first few months of the year saw hospitals and health services overwhelmed with the sick, and a population fearful of catching a virus that had been aggressively stigmatized by the state. COVID-related deaths rapidly mounted, though no one can be sure of the exact number given underreporting in the official data. Estimates of total deaths range from the hundreds of thousands to millions.

The post China’s Economy Turning a Corner? appeared first on Geopolitical Monitor.

]]>The post Geopolitical Snapshot: Nigeria appeared first on Geopolitical Monitor.

]]>

Nigeria’s geopolitical importance stems from its demographic, economic, and strategic weight. As the most populous country in Africa, with over 200 million people, Nigeria represents significant demographic power via a large domestic market and labor force. Furthermore, Nigeria’s diverse society, which encompasses a wide range of ethnic groups and cultures, places it at the heart of African socio-political dynamics, making it a critical player in efforts toward regional integration and cultural diplomacy.

Economically, Nigeria is one of Africa’s largest economies, with its approximately $395 billion GDP among the top three on the continent – higher than Egypt’s $358 billion and just behind South Africa’s $401 billion. The nation’s wealth is largely attributed to its extensive oil and gas reserves, making it one of the world’s leading oil exporters. Strategically, Nigeria’s location on the Gulf of Guinea grants it a pivotal maritime position, controlling crucial shipping lanes with access to significant Atlantic trade routes. This strategic maritime position is vital for international trade, especially for oil exports. Moreover, Nigeria’s role in regional and international organizations, such as the Economic Community of West African States (ECOWAS) and the United Nations, amplifies its influence on regional security, economic policies, and diplomatic initiatives. As a leading contributor to peacekeeping missions in Africa, Nigeria has a substantial impact on the continent’s security landscape. Its efforts in combating regional threats, such as terrorism and piracy, further underline its importance as a stabilizing force in West Africa.

The post Geopolitical Snapshot: Nigeria appeared first on Geopolitical Monitor.

]]>The post Geopolitical Snapshot: Egypt appeared first on Geopolitical Monitor.

]]>

Egypt’s geopolitical importance is difficult to overstate. Strategically located at the crossroads of Africa and Asia, Egypt controls the Suez Canal, one of the world’s key maritime choke points. Each year, a significant portion of the world’s trade, including a substantial percentage of global oil shipments, passes through the canal, making its security and uninterrupted operation a prerequisite for stable global supply chains. Egypt’s geopolitical weight is further buttressed by Cairo’s historical role as a cultural and political leader in the MENA region. The country has the largest population in the Arab world at approximately 102 million, serving as a significant cultural, educational, and political hub. Its peace treaty with Israel and strategic partnerships with Western countries, especially the United States, alongside its influence in the Arab League, all cast Egypt as a pivotal player in Middle Eastern politics and peace efforts, whether in Gaza or Sudan. Consequently, the stability and policy direction of the regime directly impact regional security, counter-terrorism efforts, and the dynamics of the broader Middle East and North Africa region.

A New President for Life?

Egyptians went to the polls in 2023 amid a bleak economic outlook. The outcome of the contest was a foregone conclusion, as President Abdel Fatteh el-Sisi – the military leader who had stepped in to remove Mohamed Morsi in 2013 – took 89.6% of the vote against a withering field of competition. According to a report by Human Rights Watch, the election was marred by repression of civil society, arrests, intimidation, and the lack of any viable alternative.

The post Geopolitical Snapshot: Egypt appeared first on Geopolitical Monitor.

]]>The post Central Asia’s Triangular Geopolitics: Russia, China, and the West appeared first on Geopolitical Monitor.

]]>With their geopolitically significant positioning between Russia and China, the Central Asian Republics (Kazakhstan, Uzbekistan, Turkmenistan, Kyrgyzstan, and Tajikistan) frequently tread a delicate balance. China seeks their natural resources, while Russia aims to uphold dominance within the post-Soviet economic, military, and diplomatic spheres.

The historical tie to the Soviet Union naturally links the republics to Russia. Many use the Cyrillic alphabet and have integrated Russian vocabulary into their languages, facilitating wider integration with Russia. Moreover, their technology, equipment, and military systems are predominantly Russian-based, bolstering prospects for cooperation. Russian soft power surpasses that of China or the United States in the region, notably as the favored destination for study abroad or labor migration. For instance, in Kazakhstan, 78% of Kazakhs studying abroad choose Russia.

The post Central Asia’s Triangular Geopolitics: Russia, China, and the West appeared first on Geopolitical Monitor.

]]>The post Understanding the UAE’s $35 Billion Investment in Egypt appeared first on Geopolitical Monitor.

]]>

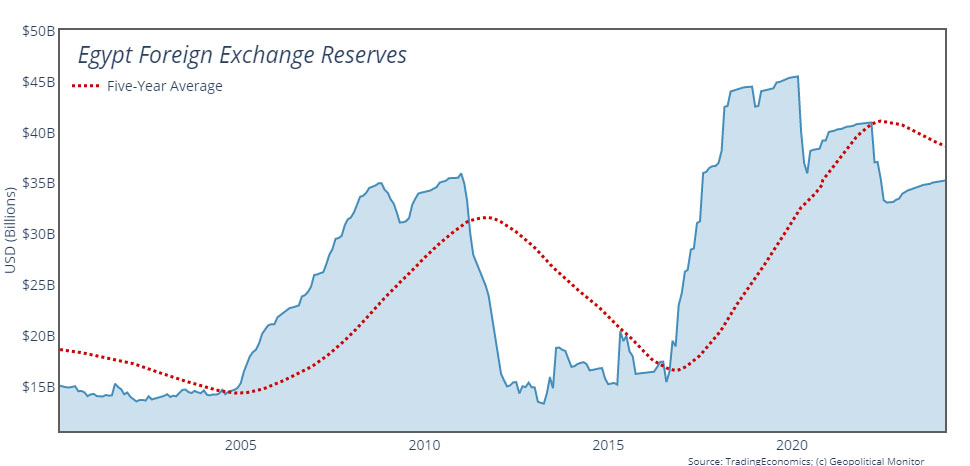

In a landmark deal, Egypt has announced a staggering $35 billion investment from the United Arab Emirates. The agreement, centered on the development of Egypt’s Ras El Hekma peninsula, marks a significant shift in regional dynamics and promises a considerable uplift for Egypt’s struggling economy.

Through its sovereign investment fund ADQ, the deal will focus on developing Egypt’s strategic northwestern coast area along the Mediterranean Sea. This project, envisioned as a “next generation city,” aims to encompass technology and light industry sectors, amusement parks, a marina, an airport, and residential developments, with the Egyptian government retaining a 35% stake.

The post Understanding the UAE’s $35 Billion Investment in Egypt appeared first on Geopolitical Monitor.

]]>