The post US Shale Resilience Puts Pressure on OPEC+ appeared first on Geopolitical Monitor.

]]>Last year, US crude oil production reached a record high of 4.1 million barrels per day (bpd), underscoring the country’s increasing role as a significant oil exporter. This uptick in production and exports has enabled the United States to penetrate markets in Asia and Europe, traditionally held by OPEC+ members. The exploitation of shale reserves in areas like the Permian Basin, based in the state of Texas, have been central to American export growth. Shale oil is prized for its light density and low sulfur content, which is desirable for refineries as a cheaper alternative to heavier and sour crudes produced by Canada, Mexico, and the Gulf region.

The post US Shale Resilience Puts Pressure on OPEC+ appeared first on Geopolitical Monitor.

]]>The post Winners and Losers in the Greenback Rally appeared first on Geopolitical Monitor.

]]>The post Winners and Losers in the Greenback Rally appeared first on Geopolitical Monitor.

]]>The post Can Blockchain Revolutionize Commodities Trading? appeared first on Geopolitical Monitor.

]]>Such unknowables have existed for as long as commodities have been traded. But technology is now intervening to disrupt convention, paving the way for new and ultimately more sustainable paradigms. Asset tokenization via blockchain technology specifically holds out the promise of revolutionizing supply chains by disclosing the mine source, chain of custody, and ESG practices of a given commodity. This information is a game-changer for consumers looking to make informed purchasing decisions: the graphite in their smartphones will finally be able to tell its story.

Technology alone is not enough; traders, investors, and consumers must be able to put it to good use. What’s needed is for companies to step up and bridge the gap. One notable example is Savala, which has partnered with DComm Blockchain to launch an innovative trading platform that will initially focus on premium graphite before expanding into other commodities. Transactions on the platform will be facilitated via the DComm Blockchain Coin ($DCM), marking a leap forward in the marriage of digital currency and commodity trading. But unlike cryptocurrencies, which tend not to be backed by any hard assets, every token will represent one ton of graphite.

This novel approach can help alleviate longstanding issues in the commodity trading space. For one, it allows grassroots investors to engage directly in commodity markets for the first time, thus encouraging the democratization of a market that has historically been dominated by elite interests. Two, it provides a level of transparency hitherto impossible for traders and investors, opening the door to better investment decisions. For example, investments can be guided by a sense of social responsibility (purchasing from miners with a record of ESG best practices) or geopolitical considerations (purchasing from miners unlikely to be targeted by sanctions). And most importantly, trading portals can act as a conduit for ESG-minded miners to raise capital, linking them up with publics that had previously lacked the opportunities and technological means to invest in commodities on their own terms. Commodity traders also benefit from improved price discovery since portals can help pull the curtain back on the opaque and top-heavy arena of privately traded commodities. End users such as auto OEMs can leverage this price discovery to hedge or even buy necessary inputs directly.

It’s no coincidence that Savala has opted to focus on the premium graphite market, as the commodity exemplifies many of the pitfalls of the status quo. In terms of its importance, there can be no question – as a durable and excellent conductor of heat and electricity, graphite finds its way into all manner of industrial and consumer products. Chief among them, at least in the context of the global energy transition, is lithium-ion batteries, which are expected to propel graphite demand to new heights over the coming years. Yet sources of this highly strategic commodity remain restricted to jurisdictions that carry significant geopolitical or ESG risk. China, for example, accounts for 65% of global graphite production and 90% of global refining, but its government instituted export curbs in late 2023 citing national security concerns. Rights organizations have expressed concern about Mozambique, the world’s second-largest graphite producer at approximately 13% of global output, where local livelihoods and ecosystems have allegedly been upended by large-scale mining. In particular, nearly all graphite mining takes place in Cabo Delgado province, home to a bloody and ongoing insurgency that has caused thousands of deaths.

In light of these supply chain issues, it comes as no surprise that Western governments are scrambling to secure new avenues of graphite production and refining capacity. The Savala portal can assist in the effort by tapping into new sources of capital and channeling it toward responsible operators. Amid a global energy transition at a critical time, the stakes couldn’t be higher. But for the first time in human history, we can at the very least hold out hope for a commodity boom that leaves the planet in a better state than what it found it in.

Richard Garner has acted as an advisor to Savala Global. The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.

The post Can Blockchain Revolutionize Commodities Trading? appeared first on Geopolitical Monitor.

]]>The post Wagner Group Post-Prigozhin: New Name, Business as Usual appeared first on Geopolitical Monitor.

]]>Shortly after his father’s death, twenty-five-year-old Pavel Prigozhin took over the reins of his father’s company, but with limited legitimacy. Little is known of Pavel’s childhood or teenage years, except that he was pampered and traveled on private yachts and jets. He fought in Syria alongside Wagner troops, earning the organization’s “Black Cross” for outstanding military service. He also fought in Ukraine, where allegedly, his social media posts gave away his position, leading to his unit being bombed. Western sanctions have been extended to the children of Yevgeny Prigozhin, making it nearly impossible for Pavel to travel internationally.

Pavel’s age and lack of his father’s skills were ultimately his downfall, and most analysts believed the Kremlin would cut a deal to completely remove him from the picture, allowing Pavel to continue to earn money with the many other companies his father left him in a multibillion-dollar empire. Under Pavel’s leadership, Wagner began recruiting again, but then suddenly stopped. By October or November of 2023, Pavel was no longer leading Wagner. There’s no official confirmation on Pavel’s whereabouts or what happened to him. He may have been sidelined or removed from power struggles within Russia. It’s also possible he’s involved with the PMCs in a less public role. Information about the Wagner Group and its leadership is often opaque and shrouded in secrecy.

While Pavel’s role, and even if he is still alive, remain unknown, it is known that Wagner’s commercial and military interests have been divided between Russia’s numerous intelligence services and Putin’s allies. Parts of Wagner may have been absorbed into Rosgvardia, also known as the Federal Service of the National Guard of the Russian Federation. However, command over the largest part of Wagner’s overseas operations has been assumed by General Andrei Averyanov, a high-ranking officer in Russia’s military intelligence (GRU). General Andrey Averyanov, the former leader of a targeted assassination group, rose to international infamy for the failed poisoning of Russian dissident-in-exile, Sergei Skripal in Salisbury, UK in 2018.

The Defense Ministry established a number of other private military companies (PMCs) to recruit former Wagner men for operations in Africa or the Middle East. A PMC called Redut, established in 2008, has been fighting in Ukraine, while another PMC, Convoy, was established in Russian-occupied Crimea in 2022. Wagner’s Ukrainian operations now come under the name of the Volunteer Corps, while other arms-length, covert operations have been incorporated into the Expeditionary Corps. Effectively, the multibillion-dollar PMC business has been taken over by the Kremlin, with the Expeditionary Corps dubbed “Wagner 2.0.”

Russia’s strategy in using the PMCs is to undermine U.S. power and increase Moscow’s influence while maintaining plausible deniability. They provide security for foreign leaders while also offering training for their troops and sometimes engaging in ground combat, providing combat support, or conducting special operations. The PMCs aid Moscow’s foreign policy objectives by carrying out military operations, projecting Russia’s power, furthering Moscow’s political influence, gathering intelligence, and generating revenue. In Mali and Sudan, the Wagner Group was instrumental in securing gold and diamond mines, ensuring that certain local military leaders continue to benefit from them, while also transporting precious metals and stones back to the Kremlin.

Wagner was active in Libya from 2018. Russian PMCs are also fighting in Syria and Ukraine, and possibly in as many as 30 countries in total. Wagner had been propping up regimes across Africa, as well as controlling mineral extraction activity, namely in gold. Operations in Africa are continuing with mercenaries fulfilling existing contracts. The Kremlin is offering a “regime survival package” to governments in Africa in exchange for access to natural resources. The Russian government is also working to change mining laws in West Africa, attempting to unseat Western companies.

Now, those operations in Africa are continuing under the Africa Corps. Russia is negotiating with the Central African Republic to open a new military base there. The group is also active in Libya, Mali, Sudan, and Burkina Faso. The original plan was to recruit and place 40,000 Russian fighters across Africa. This target was reduced to 20,000, but by the end of 2023, even this reduced target had not been fulfilled. Consequently, the empty billets are being filled with recruits from Africa. Particularly in the Central African Republic (CAR), former fighters are finding that they are unemployable after a UN ceasefire. So, they are taking jobs with the Russian PMCs.

Another region where Russian PMCs are active is the Sahel, encompassing countries bordering the southern edge of the Sahara Desert. It has become known as the ‘coup belt’ due to a recent surge in military takeovers. Since 2020, at least five successful coups have plagued the region, including two in Mali, two in Burkina Faso, and one in Niger. The three nations withdrew from the regional bloc – The Economic Community of West African States (ECOWAS) – and created their own “Alliance of Sahel States.”

These coups all shared a similar theme: the new military leaders distanced themselves from Western powers. French troops, deployed for years to combat jihadist activity from groups like the Islamic State in the Greater Sahara (ISGS) and Jama’at Nusrat al-Islam wal-Muslimin (JNIM), were expelled or faced pressure to leave. Additionally, the juntas want the US military out of the region. It’s important to note that public dissatisfaction with government corruption and inability to address security concerns, including the rise of these terrorist groups, were also significant factors behind the coups, not just Western influence.

The United States is struggling to maintain its foothold in Africa’s Coup Belt, particularly after French troops were expelled from Mali and Burkina Faso. Washington seeks to prevent Russian PMCs from filling the security void. However, Moscow holds a certain appeal for the region’s newly established military juntas. Unlike Western powers, Russia doesn’t pressure them on human rights issues or democratic reforms. Additionally, the U.S. operates within the constraints of the international rules-based order, limiting its flexibility in negotiations. In contrast, Russia prioritizes its own interests and operates with less transparency, allowing it to deny involvement with PMCs. This opacity gives Russia an advantage, allowing them to cultivate influence in the region without directly committing troops.

The U.S. has several reasons for wanting to remain in the region. First, reports suggest the effectiveness of Russian PMCs in combating terrorism is debatable. Second, the U.S. is concerned about the potential for a detrimental economic impact on these already poverty-stricken countries. Cutting ties with Europe and facing potential sanctions could leave them economically dependent on Russia, with most of the wealth and benefits concentrated among the military rulers.

Furthermore, the coups have resulted in a curtailment of human rights and basic freedoms, with no expectation of full restoration. Unlike Western partners who would pressure for democratic reforms and respect for human rights, Russian PMCs are unlikely to exert any such influence. This lack of pressure is likely to further erode the quality of life for average citizens in these already struggling nations.

The presence of Russian PMCs is expected to expand in Africa, and with it, Russia’s influence. U.S. influence will decline unless Washington finds some way to dislodge the Russian PMCs. And unfortunately, citizens of these African countries will see a deterioration in their quality of life, standard of living, and general safety.

The post Wagner Group Post-Prigozhin: New Name, Business as Usual appeared first on Geopolitical Monitor.

]]>The post Geopolitical Snapshot: Nigeria appeared first on Geopolitical Monitor.

]]>

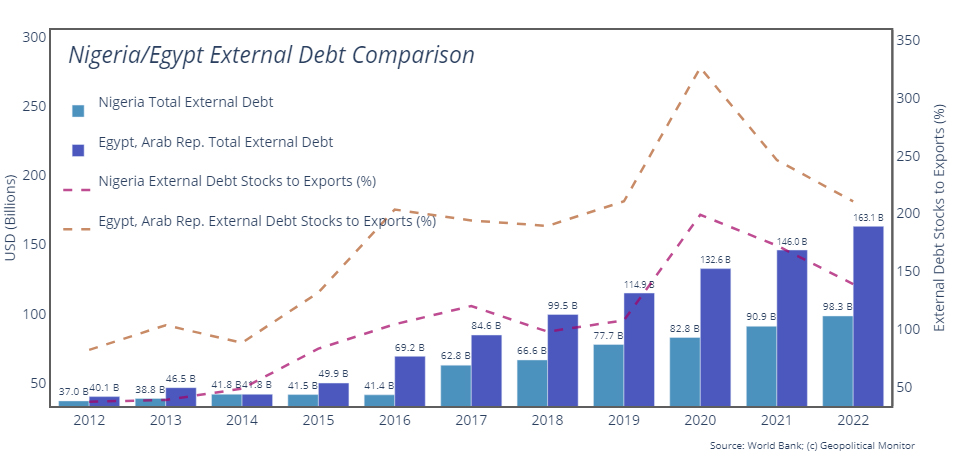

Nigeria’s geopolitical importance stems from its demographic, economic, and strategic weight. As the most populous country in Africa, with over 200 million people, Nigeria represents significant demographic power via a large domestic market and labor force. Furthermore, Nigeria’s diverse society, which encompasses a wide range of ethnic groups and cultures, places it at the heart of African socio-political dynamics, making it a critical player in efforts toward regional integration and cultural diplomacy.

Economically, Nigeria is one of Africa’s largest economies, with its approximately $395 billion GDP among the top three on the continent – higher than Egypt’s $358 billion and just behind South Africa’s $401 billion. The nation’s wealth is largely attributed to its extensive oil and gas reserves, making it one of the world’s leading oil exporters. Strategically, Nigeria’s location on the Gulf of Guinea grants it a pivotal maritime position, controlling crucial shipping lanes with access to significant Atlantic trade routes. This strategic maritime position is vital for international trade, especially for oil exports. Moreover, Nigeria’s role in regional and international organizations, such as the Economic Community of West African States (ECOWAS) and the United Nations, amplifies its influence on regional security, economic policies, and diplomatic initiatives. As a leading contributor to peacekeeping missions in Africa, Nigeria has a substantial impact on the continent’s security landscape. Its efforts in combating regional threats, such as terrorism and piracy, further underline its importance as a stabilizing force in West Africa.

The post Geopolitical Snapshot: Nigeria appeared first on Geopolitical Monitor.

]]>The post BRI, PGII, and Global Gateway: Infrastructure Development Goes Global appeared first on Geopolitical Monitor.

]]>Beijing’s new focus on a smaller, smarter, and greener Belt and Road Initiative (BRI) and the West’s commitment to infrastructure adhering to ESG standards could, in theory, help turn a new generation of roads, railways, dams and ports into economic assets that effectively mitigate debt, corruption and environment risks.

There is a huge global infrastructure investment gap. Among developing nations, it’s particularly acute, making it hard to tackle the demands and challenges of rapid population growth. Moreover, the funding shortfall limits these countries’ financial prospects at best, deepening poverty and, ultimately, threatening to destabilize them at worst.

Just over ten years ago, Beijing recognized the investment need – and, its critics would argue, the economic and political influence that addressing the need could leverage. China became the developing world’s biggest lender, largely through the BRI, whose membership runs to over 150 countries, more than a dozen of them EU states. But some recipients of loans have struggled to repay. As of October, member countries owed more than $300 billion dollars to the Import-Export Bank of China, according to Chinese officials.

At the same time, the Chinese economy has cooled, leaving less room for foreign expenditure. And, as their own economic circumstances have worsened, there are signs that some Chinese are beginning to question the merits of spending billions abroad. Against this background, investment in the BRI has declined significantly. Long critical of its lack of transparency and debt implications, and concerned over the geopolitical influence it allows China to wield, the West has now sensed an opportunity to roll out rival infrastructure schemes.

Launched with great fanfare in 2013, the BRI was intended to present China as a champion of the developing world, though there was an important domestic economic driver too. The country needed to secure new markets for excess capacity after the global financial crash when Beijing invested heavily to stimulate in its own economy (China now has a substantial trade surplus with BRI members). The BRI has also been seen as a means of promoting Beijing’s authoritarian model of governance and advancing its geostrategic goals, primarily by shifting countries out of America’s sphere of influence.

Under the BRI, Beijing has loaned around one trillion dollars to low- and middle-income economies to develop sectors such as transport, logistics, utilities and energy. As part of the initiative, health and education programs have also been pursued. Infrastructure outcomes have been mixed. Many BRI signatory states have benefited substantially, particularly in Southeast Asia. Yet a sizeable minority of infrastructure projects, reports AidData, have experienced major implementation problems (including corruption, labor violations, and environmental hazards).

While a significant number of BRI countries have fallen into heavy debt, requiring bailouts from China, there is limited evidence to suggest that Beijing is engaged in debt-trap diplomacy, essentially the claim that it looks for economic concessions from countries struggling to repay loans. Indeed, in recent years it has sought to de-risk or future-proof investments, by putting in place “stronger loan repayment and project implementation guardrails,” according to Brad Parks, the executive director of AidData.

At the third Belt and Road Forum in October, China said it would commit more than $100 billion for what looks like a rebranding of the BRI – notably coinciding with an uptick in BRI expenditure last year, the highest since 2018. Beijing seems to have acknowledged that the problems that have dogged the BRI should be addressed if it is to be credible. And the rebrand has not come out of the blue, seemingly building on efforts in previous years to make the BRI more sustainable through a series of green policies and guidelines.

In the new iteration of the BRI, provision will be made for big-ticket and “small yet smart” infrastructure, including green and low-carbon energy projects, with signs of possibly a more cautious financing approach, says China Dialogue. Also there’s a new emphasis on host country agency; an effort to combat the narrative that BRI projects directly benefit China. And to address integrity and compliance issues, companies participating in projects will come under closer scrutiny.

The rebranding of the BRI has emerged as the West attempts to give developing countries alternative options. The European Union’s Global Gateway, launched in 2021, aims to raise up to 300 billion euros of public and private funds for sustainable and high-quality infrastructure projects, which comply with social and environmental standards.

As of October, 89 projects have got under way globally, with 66 billion euros so far committed. The same month, the European Commission chief Ursula von der Leyen was very clear about the purpose of the Global Gateway, insisting it was about “better choices” for developing nations. “For many countries around the world, investment options are not only limited, but they all come with a lot of small print, and sometimes with a very high price,” she said.

In 2022, the US and its G7 allies formally launched the Partnership for Global Infrastructure and Investment (PGII), which is looking to mobilize 600 billion US dollars of public and private investment for quality, sustainable infrastructure. Its two signature projects are transport corridors, one linking India, the Arabian Gulf, and Europe, the other in Africa connecting Angola, Zambia, and the Democratic Republic of Congo. The PGII, like Global Gateway, makes no bones about its intentions. It says it offers “a positive alternative to models of infrastructure financing and delivery that are often opaque, fail to uphold environmental and social standards, exploit workers, and leave the recipient countries worse off.”

While Western attempts to lower the risks associated with large infrastructure projects is a step in the right direction, doubts remain about the feasibility of these initiatives. Amid the global slowdown, will creditor governments be able to raise the funds needed? And will the schemes attract sufficient private investors if investment-recipient countries are politically and financially unstable, raising ROI uncertainty? Moreover, it might turn out to be hard to identify and then deliver projects that adhere to high ESG standards.

At the same time, questions could also be raised about China’s infrastructure rebrand. Developing nations that have had bad experiences of the BRI may wonder whether there’s any real substance behind the new offering. Not least those that have incurred big debts – once bitten, twice shy. And countries concerned about the BRI pushing them further into China’s sphere of influence might also have second thoughts, especially if there are more attractive Western projects on the table.

While the geopolitical rivals’ schemes have their doubters, it must be said that the West’s recognition of the sustainable infrastructure needs of the developing world and China’s apparent willingness to draw lessons from the past are positive moves. Emerging economies will now have choices, at least. Previously, there would have been few if they turned down Chinese overtures. Moreover, a decade after the launch of the BRI, they will be – or should be – more aware of, and better able to assess, the relative merits and potential pitfalls of big infrastructure projects.

Yigal Chazan is an international affairs journalist, with a special interest and expertise in geoeconomics.

The views expressed in this article belong to the authors alone and do not necessarily reflect those of Geopoliticalmonitor.com.

The post BRI, PGII, and Global Gateway: Infrastructure Development Goes Global appeared first on Geopolitical Monitor.

]]>The post Soy Prices Slip from Post-Pandemic Highs appeared first on Geopolitical Monitor.

]]>

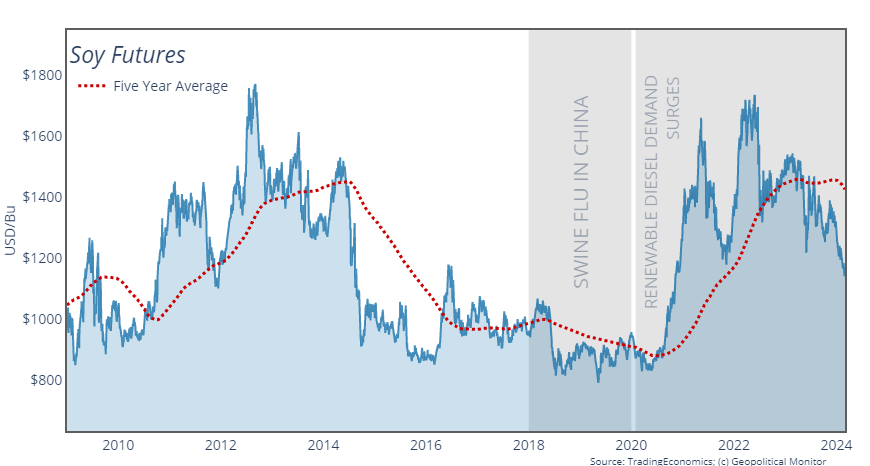

As one of the world’s most traded commodities, soybeans are a critical feature in the global agricultural landscape. Movement in soy futures can influence the stability of different countries: shaping trade policies, impacting diplomatic relations, and determining domestic stability through the movement of key input prices. Countries like the United States, Brazil, and Argentina, which are leading soybean producers, often leverage their production capacity as a significant economic asset, affecting global supply chains and price dynamics. On the other side, major importers like China, whose massive demand for soybeans stems from its vast hog sector, view soybean imports through the geopolitical lens, ascribing the commodity critical importance for food security and agricultural policy. This geopolitical significance was evident during the US-China trade war, as soy was one of the first commodities targeted for sanctions in 2018.

The post Soy Prices Slip from Post-Pandemic Highs appeared first on Geopolitical Monitor.

]]>The post Geopolitical Snapshot: Pakistan appeared first on Geopolitical Monitor.

]]>

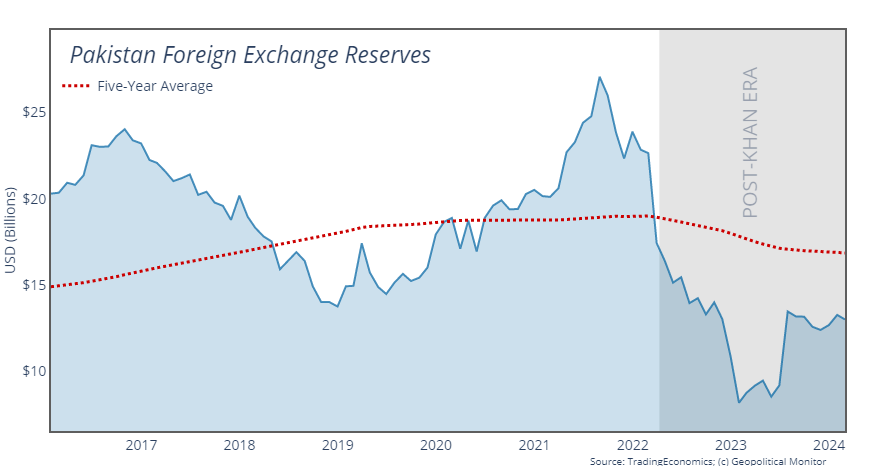

Though it has yet to realize its economic promise, Pakistan more than makes up for this in military and diplomatic weight. The country is home to a sizable and overwhelmingly young population of over 240 million people, the fifth largest in the world; it boasts a modern and well-funded military, armed with nuclear weapons; and it borders key countries like India, China, Iran, and Afghanistan. The authorities in Islamabad, whether political or military, are also frequently involved in various internal and external conflicts, ranging from the rise, fall, and re-rise of the Taliban to cross-border Baloch separatism and India-Pakistan tensions.

The post Geopolitical Snapshot: Pakistan appeared first on Geopolitical Monitor.

]]>The post Global Wheat Markets Stabilize amid Ukraine War appeared first on Geopolitical Monitor.

]]>

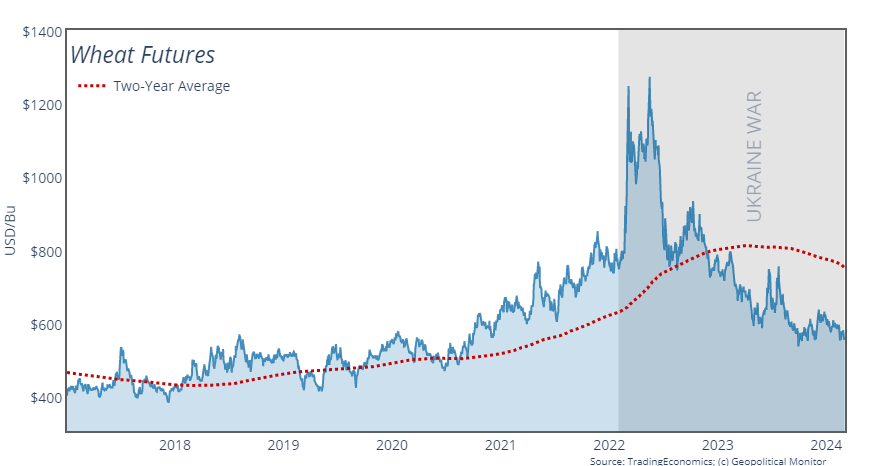

The geopolitical significance of staple foods like wheat is difficult to overstate, as price fluctuations over the course of human history have fueled the rise and fall of regimes, political systems, and even civilizations. At the dawn of 2024, global wheat markets are still recovering from significant supply-side disruptions from the pandemic and Ukraine war. This recovery is anything but assured looking ahead, as a complex interplay of factors threaten future price volatility. These include geopolitical tensions, supply and demand dynamics, weather conditions, and macroeconomic forces.

The post Global Wheat Markets Stabilize amid Ukraine War appeared first on Geopolitical Monitor.

]]>The post Police Mission Will Not Stem the Chaos in Haiti appeared first on Geopolitical Monitor.

]]>The setbacks relate to the blocking of the mission by the high court, which referenced the constitution of Kenya, specifically with regard to the fact that the mission is not a military peacekeeping operation, and police may only be legally deployed if a reciprocal agreement exists with the state to which police are being deployed. The government has now challenged the high court’s assessment and remains committed to going through with the mission; however, the primary concerns here are operational, not legal.

Kenya Police Reputation

The Kenyan police service has struggled to maintain a good reputation in the 21st century, facing allegations of targeted killing and reports of unwarranted use of force. While efforts to legitimize and stabilize policing have borne fruit, there are still consistent confirmed reports of police misconduct. Some examples of police malfeasance and illegal activity in the previous month include:

27 February 2024: Murder of a prison warden by an intoxicated police officer.

26 February 2024: Two officers arrested for extorting a suspect.

19 February 2024: Officer arrested for distributing alcohol illegally.

18 February 2024: Four officers arrested for disregarding governor’s orders and consuming alcohol publicly.

6 February 2024: Two officers arrested for the disappearance of a firearm.

6 of February 2024: Officer arrested for rape of student in custody.

1 February 2024: Officer arrested for taking bribes.

30 January 2024: Officers arrested following unexplained escape of suspect.

30 January 2024: Two officers arrested for solicitation of bribes.

The Haitian mission, should it go ahead, will be an enormously complex task of policing, investigation, security, and very likely heavy fighting in key areas. The task would be complex enough for elite police forces from around the world and the deployment of regular police officers from a state that is still struggling to maintain consistent policing standards is a concerning point. In addition, recent events have overtaken the planned police mission and the situation on the ground in Haiti is rapidly changing.

Haiti Outlook

The Haitian mission itself will not be a simple security operation. The gangs are well-armed and organized, and are easily able to challenge military and police units on the ground. Prime Minister Henry’s recent trip has triggered chaos as two major gangs launched attacks on prisons, government offices, and police posts, resulting in a mass prison break in the capital. The chaos has resulted in rioting as security forces close ranks on critical infrastructure at the airport and central government structures. The situation is critical as gangs have called for the resignation of the PM, threatening to overrun the government’s remaining key areas.

Following a period of uncertainty over the whereabouts of Prime Minister Henry, he is confirmed to be in Puerto Rico after his plane was diverted by Dominican authorities. During this time, the United States and Caribbean leaders have called for Henry to step down while Washington and UN push to expediate the Kenyan police deployment funded by UN member states.

The gangs themselves are complex in structure, and while they started as criminal organizations, they have since evolved into a form of militancy with a distinct political narrative at odds with the criminal nature of their activities. Former police officer turned G9 gang leader Jimmy “Barbeque” Chérizier dresses in fatigues and beret, styling himself as a revolutionary rather than a criminal leader. Regardless of the narrative, the reality is that the gangs are overwhelmingly powerful.

While up to date information in the field is difficult to acquire, G9 and the G-PEP gang, a coalition of gangs that joined to counteract the growing G9 influence, are the largest operating gangs in Port Au Prince. With the gangs actively threatening not only the stability and security of the region, but actual political processes as well, the threat they pose is significantly higher. Gang leaders such as Cherizier seem to have grander ambitions than the control of territory, but rather the control of Haiti as a whole.

Impact

While the gross insecurity and power of the gangs has prompted a growing urgency for the support mission, the efficacy of the Kenyan police mission, already questioned prior to the current situation, is a serious concern. 1,000 deployed police officers in what is currently a lawless conflict zone is unlikely to yield positive results and may well lead to major casualties in the support mission as well as civilian insecurity. The challenges facing the police deployment have been discussed at length and have only become more complex.

It is highly unlikely a successful democratic transition will take place in the event of Henry stepping down and elections being held. Gang leaders have enough influence to directly affect any democratic process and with little to no legal authority or independent commissions to secure transparency, a legitimate election at this stage is untenable.

Should Henry step down and an election occur, the structure of the planned Kenyan support mission would collapse as the legislative requirements for a policing mission, already controversial in Kenya, would no longer exist. It is unlikely that a new government, even if it’s somehow not under the influence of gangs, would continue with the policing agreement with Kenya, which made the deployment possible in the first place, especially given that it was the deployment itself that apparently triggered most of the recent chaos in the capital. In such a case, UN member states would likely be required to invoke article 138, the responsibility to protect, in order to deploy what would at that point become an intervention force. The change in narrative and mission would be a laborious process, especially considering states have been hesitant to lead any mission into Haiti.

In conclusion, should Henry return to Haiti, the Kenyan police deployment, despite the many challenges facing it, would need to deploy extremely rapidly, which is an unlikely prospect due to the time frame of the agreement and the resistance the action faces in Kenyan courts. Should Henry step down, the sudden power vacuum would only provide more means for gangs to control Haiti and further exacerbate insecurity and chaos in the state. In either case, a Kenyan police deployment is a dangerous and unreliable solution as the situation has become far more complex.

The post Police Mission Will Not Stem the Chaos in Haiti appeared first on Geopolitical Monitor.

]]>