The post ECB Policy Measures Proving Ineffective appeared first on Geopolitical Monitor.

]]>Part of the reason for this came from the fact that the economic prospects in several countries were so fragmented as the weakest countries in the member union will likely require different measures when compared to the stronger member countries. Specifically, this means that nations like Greece, Portugal, and Spain will need to be dealt with differently than the likes of Germany and Austria. If this is not done correctly, we could be looking at several more years of economic stagnation in the region.

QE Not Achieving Desired Effect

But even with all of the attention paid to these factors, it does not appear as though the quantitative easing programs enacted last January are having their desired effect. In theory, QE programs will almost always have a negative impact on the currency of a region. This is actually a positive because lower currency valuations make export products cheaper for foreign consumers, and this can bring added sales for a region that might have otherwise been stalling.

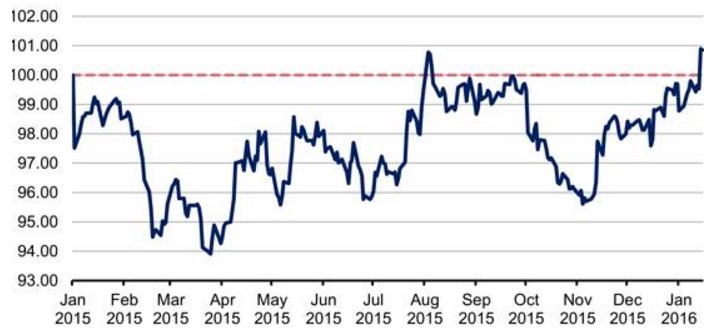

But the specific programs enacted by the ECB have not generated this result, as the value of the Euro is now higher than it was when these QE programs were first initiated by the ECB.

In the chart above, the red dotted line indicates the value of the Euro against a basket of its most commonly traded counterparts. This is a more important indicator than anything that can be determined by looking at any single currency pair (for example, the EUR/USD) because the Eurozone has significant trade relationships with all of the world’s major economies. So, while we might be seeing relatively low values in the Euro against the US Dollar, this is simply not the case when we assess things from a global perspective.

Looking Ahead

Going forward, it will be important for the ECB to continue monitoring the value of its currency in these terms. Failures here could mean that we will see changes in the monetary policy agenda that is being laid out by the central bank and this could ultimately suggest continued volatility in the shared Euro currency. This will have significance for both consumers and investors, as regional stock markets could be negatively impacted by excessive price instability.

We need look back only a few years to see the various ways that the Eurozone’s sovereign debt crisis has impacted the global economy, so there is really something here for everyone when we are looking to judge the effectiveness of the ECB’s policy measures to stimulate growth in the region. This is an issue that has faded from the headlines over the last year – but when we look at the various ways this story is playing out, we could very well see this issue become a dominant factor once again in the world’s financial news headlines.

The post ECB Policy Measures Proving Ineffective appeared first on Geopolitical Monitor.

]]>The post US Federal Reserve Could Sink Indonesian Stock Market appeared first on Geopolitical Monitor.

]]>When dealing with these issues, a good deal of importance should be placed on the monetary policy outlook at the US Federal Reserve. This is because the Fed is widely viewed as the first major central bank likely to begin raising interest rates before the end of this year. If these projections are accurate, credit will become more expensive and consumer spending activity in the US will likely begin to slow. Activity like this places key limitations on one of Indonesia’s key export markets, so there is a strong chance that increases in interest rates will have a material impact on the ability of Indonesian companies to generate improved revenue growth into next year.

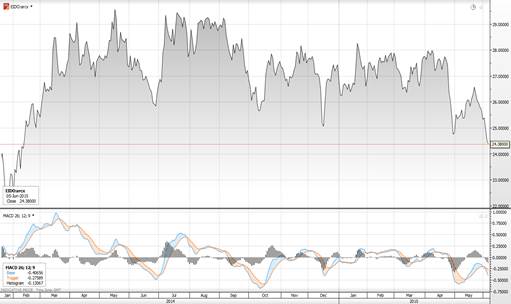

Of course, this does not mean that stock markets in Indonesia will fall forever. But it is important to note that interest rate speculation in the US has created a more negative outlook for Indonesian stocks in the near-term. In the chart above, we can see market valuations for the iShares MSCI Indonesia Market Index Fund (NYSEARCA:EIDO) dating back to the beginning of last year. EIDO is one of the most commonly watched gauges of stock performance in Indonesia as a whole and for most of that time, we have seen steady declines in market valuations. This activity coincides well with rising expectations that the Federal Reserve would tighten monetary policy in the U.S. So for those that are interested in gaining exposure to stock markets in Southeast Asia (and Indonesia, in particular), it makes a good deal of sense to remain aware of any changes in the interest rate policy agenda that is present in the United States.

Any suggestions that the Fed is willing to hold-off on raising rate will likely be positive for emerging market stocks. But if we start to see any direct commentaries made which highlight a need for higher interest rates in the US, we could see additional declines in these types of assets. At this stage, an interest rate increase of just one-percent would likely send valuations in Indonesian benchmarks like EIDO back below its all-time lows of around 21.90. From a psychological perspective, a move like this could create a wave of panic selling for stocks in Southeast Asia and in emerging market assets as a whole. Because of this, it makes little sense to start gaining significant long exposure in this sector of the market.

Of course, this does not mean that investors should avoid buying into emerging markets. Indonesia is still the fourth-largest country in the world in terms of population and it is a country that tends to receive less attention in the financial media when compared to nations like India and China. So, for those with a longer-term outlook, there is still good value to be had in assets like EIDO. But the prudent investor will be the one that waits until the US Federal Reserve starts raising interest rates so that rest of the market has the opportunity to offer these stocks at on-sale prices.

The opinions, beliefs, and viewpoints expressed by the authors are theirs alone and don’t reflect any official position of Geopoliticalmonitor.com.

The post US Federal Reserve Could Sink Indonesian Stock Market appeared first on Geopolitical Monitor.

]]>